ChinaTravelNews, Ritesh Gupta - Have meta-search companies found a way out to run operations in a viable manner in China? Yes, collaborative path i.e. cooperating with local entities is proving to be a feasible route, but what about gaining acceptance for a brand that is eminent outside China and working a profitable, standalone model around it?

We don’t need to introspect too much; Uber’s trajectory is a prime example of how challenging this market continues to be. In fact, barring Apple or maybe a handful of others, the journey of settling down as a consumer technology company hasn’t been a successful one for many.

And it isn’t getting easier either.

Improvisation is must, but don’t forget China

The blend of technology, data and analytics is pushing travel intermediaries to improvise on every front, and this adjustment has to be China-centric for this market. Be it for powering travel search on WeChat or running a flagship store, say on Alitrip, every move needs to be in sync with what various digital ecosystems (primarily Baidu, Alibaba and Tencent, or BAT) stand for or how top OTAs are moving in the market.

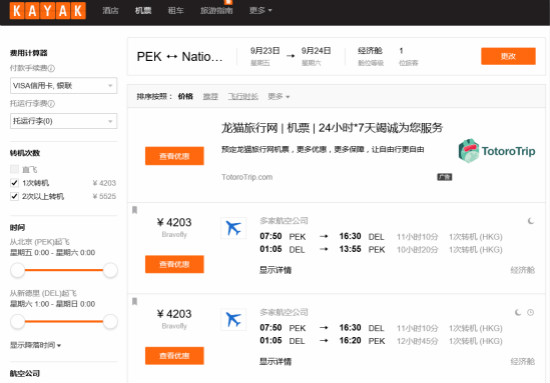

For instance, talking of meta-search, it shouldn’t be forgotten that this category, be it for China or outside of it, is evolving considerably. As tnooz evaluated recently, with TripAdvisor coming across both as a meta-search and OTA, with listing hotels on Kayak, Trivago and Google, the days of classic traffic generation model vs. transactional business are over. In fact, we are gearing up for “meta meta-search”. And if we talk of China, here also meta-search engines are moving further up the travel booking funnel.

Referring to the diminishing disparity between OTAs and meta-search companies, Amy Wei, Kayak's Director - Greater China says, “The traffic generation model will continue to be more challenging.”

Of course, one would look at APIs, widgets and white labels to power travel search. Here, the key would be to be a part of massive ecosystems run by the likes of Tencent and Alibaba. Skyscanner recently acknowledged that the team intends to serve the traveller “seamlessly”, and stated that the team is always working on integrations and “connectivity” to trigger such experiences with various partners.

Wei shared that the majority of Kayak’s users in China are searching for outbound, longer-haul flights and international hotels. The association of Ctrip and its portfolio of companies with the Priceline group, which also includes Kayak, is capitalizing on inbound and outbound traffic, though no official word on how Kayak would end up showing hotels from Ctrip, Agoda or Booking.com.

(On another note, if we look at how TripAdvisor and Priceline tied up for “instant booking option”, there are indications that something might work out on similar lines, featuring a local OTA, here in China, according to sources).

Also, China has seen several models on the transaction side, too – B2B or open platforms in addition to traditional B2C OTAs.

Wei acknowledges that open platforms create greater competition and increase consumer’s choice.

But one can’t follow any channel for its reach, just because it has gained traction.

“As seen in the market, it can also be susceptible to problems such as fake ticketing and bookings. Challenges to provide accurate, bookable fares will increase when more of these platforms emerge. B2B presents opportunity to grow the meta-search space,” Wei says.

Offering value via strong product

Another way to move up the funnel is by counting on strong digital assets, say via native App features such as traveler inspiration timeline and push notification of travel ideas.

Wei says Kayak intends to position themselves as an “ultimate must have travel tool”, building an integrated, offering for the user during all stages of travel, not just during the search/ plan stage. She spoke about inspiration, planning, booking and experience.

“The role of a meta is no-longer revolving only around flight and hotel search,” said Wei, who shared that the company has introduced new Activities vertical, where users can search for things to do in their holiday destination. “Kayak has been revamping the Trips product, which is an itinerary / trips management tool. Just forward any booking confirmation email to trips@cn.kayak.com, and Kayak’s algorithms will read the confirmation email, then automatically organize the trip into an itinerary within the tool.”

As for the Facebook Messenger Bot already launched in select Kayak English locales, Wei said Asian language support will come soon. Kayak’s messenger bot can answer basic, natural-language search queries for flights or hotels, and its goal is to capture multiple stages in a traveler’s typical journey. For example, the bot starts with the ability to answer basic questions, such as, “where can I go for 100 dollars?” or “beach getaway for 300.” “Hopefully this type of bot can be adapted to Chinese platforms in the future,” she said.

Kayak is improving facilitated booking process and interface. “With such fast growth in mobile, meta-searches in China will need to adapt and consider how to drive mobile conversion. The answer seems to lie in facilitated booking flows for China,” said Wei, who added that Alipay and WeChat Pay have achieved “super high adoption rates in China” to drive mobile bookings.

Beyond localising product and team

“Foreign players have long realised they need to localise product and team, and deal with regulatory requirements. However, as we have seen with eLong and Uber, it is still challenging for any foreign entrant due to the sheer scale of competitors who are already established in this vast market,” shared a source.

A critical question then is how to make the most of marketing expenditure. Of course, collaboration and making the most of partner’s traffic is fine, but if a brand is ambitious enough to compete for traffic, then one has to stave off peculiar intricacies. For instance, Baidu, Tencent or Alibaba ecosystems are known for offering one platform for messaging/ socialising, content consumption, shopping and transactions. A marketer is sort of locked in a data ecosystem, which is not transferable. “So what we call is a “walled garden” – you can’t get data out of it,” shared a source. Data can only be used if it’s used to buy inventory within the publisher’s own ecosystem. Hence targeting options are severely restricted. Also, in other countries, dominant ad exchange platforms are not many, and are mainly Google and Facebook. The trading platform in China is more decentralized. And within these ecosystems, travel verticals are not only in a position to capitalize on the topic, but they are also savvy enough to make technological advancements. For instance, Alitrip is relying on data analysis as Alibaba online penetration of retail in China is growing, and relevant content/ ads are being displayed buoyed by data analysis. Also, Alitrip has chosen to integrate VR technology into online hotel reservation, enabling users to have an immersive view of a hotel on its App, from hotel lobby all the way to the guest rooms.

It needs to be highlighted that the meta-search category is still in its nascent stages. As momondo indicated earlier this year, often users get confused about what meta-search engines do differently from OTAs, which is of course to create transparency of the entire market at the time of search as opposed to a more limited inventory as well as remaining independent by not selling anything. But no doubt meta-search engines need to show some spark in terms of gaining acceptance for running a powerful brand for audience in China. Otherwise, they will have to remain content with either collaborations or inbound business based on strategic partnerships, content and connectivity that is there in their arsenal.