Ctrip.com International, Ltd. announced its unaudited financial results for the second quarter ended June 30, 2019.

Highlights for the Second Quarter

* Strong financial results for the quarter

Income from operations increased by 84% year-over-year to RMB1.3 billion (US$194 million). Excluding share-based compensation charges, non-GAAP income from operations increased by 43% year-over-year to RMB1.7 billion (US$251 million) in the second quarter of 2019.

Net revenue increased by 19% year-over-year to RMB8.7 billion (US$1.3 billion) in the second quarter of 2019.

* International businesses sustained robust growth momentum

The growth rate of the international hotel business and international air business (excluding the Skyscanner business) in the second quarter of 2019 more than doubled that of the China outbound traffic growth in the same period.

In the second quarter of 2019, revenues generated from international businesses, including travel services for cross-border travelers in Greater China area and users in foreign countries, accounted for over 35% of total revenue in the second quarter of 2019.

* Presence in lower-tier cities in China

Ctrip branded low-star hotel room-nights increased more than 50% year-over-year in the second quarter of 2019.

Gross merchandise value, or GMV, of the offline stores experienced continued strong growth, with daily GMV reaching RMB120 million during peak days.

"We are encouraged by our results across our businesses and markets," said Jane Sun, Chief Executive Officer. "Our team continued to push the product coverage in scope and depth, improve customer service quality, and expand our exposure in domestic and oversea markets. We are confident and excited about the long-term future for the travel industry in China and the world."

"Today, we also announced a proposal to change the company's name to Trip.com Group Limited," said James Liang, Executive Chairman. "The new name reflects the services and products we provide, and can be easily remembered by global users. In October, we will celebrate the 20th Anniversary. Over the next decade, we will strive to become one of the most innovative and respected companies in the global travel industry."

Financial Results and Business Updates

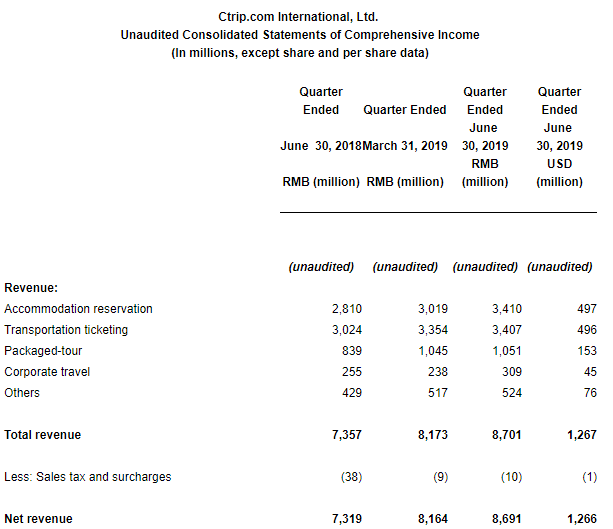

For the second quarter of 2019, Ctrip reported net revenue of RMB8.7 billion (US$1.3 billion), representing a 19% increase from the same period in 2018. Net revenue for the second quarter of 2019 increased by 6% from the previous quarter.

Accommodation reservation revenue for the second quarter of 2019 was RMB3.4 billion (US$497 million), representing a 21% increase from the same period in 2018, primarily due to strong execution by brand teams to increase the accommodation choices we offer and provide a continuously improving consumer experience. Accommodation reservation revenue for the second quarter of 2019 increased by 13% from the previous quarter, primarily due to seasonality.

Transportation ticketing revenue for the second quarter of 2019 was RMB3.4 billion (US$496 million), representing a 13% increase from the same period in 2018, primarily driven by strong international air ticketing demand and an increase in ground transportation. Transportation ticketing revenue for the second quarter of 2019 increased by 2% from the previous quarter.

Packaged-tour revenue for the second quarter of 2019 was RMB1.1 billion (US$153 million), representing a 25% increase from the same period in 2018, primarily driven by significant traffic from offline stores and high demand of customized tours. Packaged-tour revenue for the second quarter of 2019 remained consistent with that for the previous quarter.

Corporate travel revenue for the second quarter of 2019 was RMB309 million (US$45 million), representing a 21% increase from the same period in 2018, primarily driven by expansion in corporate customer base and an optimized product mix trend. Corporate travel revenue for the second quarter of 2019 increased by 30% from the previous quarter, primarily due to seasonality.

Gross margin was 79% for the second quarter of 2019, compared to 80% in the same period in 2018, and remained consistent with that for the previous quarter.

Product development expenses for the second quarter of 2019 increased by 17% to RMB2.6 billion (US$385 million) from the same period in 2018, product development expenses increased by 4% from the previous quarter, primarily due to an increase in product development personnel related expenses. Product development expenses for the second quarter of 2019 accounted for 30% of the net revenue for the same period. Excluding share-based compensation charges, non-GAAP product development expenses for the second quarter of 2019 accounted for 28% of the net revenue for the same period, which increased from 27% in the same period in 2018 and remained consistent with those for the previous quarter.

Sales and marketing expenses for the second quarter of 2019 decreased by 4% to RMB2.1 billion (US$307 million) from the same period in 2018, decreased by 5% from the previous quarter, primarily due to a decrease in sales and marketing activities related expenses. Sales and marketing expenses for the second quarter of 2019 accounted for 24% of the net revenue for the same period. Excluding share-based compensation charges, non-GAAP sales and marketing expenses for the second quarter of 2019 accounted for 24% of the net revenue for the same period, which decreased from 29% in the same period in 2018 and 27% in the previous quarter.

Income from operations for the second quarter of 2019 was RMB1.3 billion (US$194 million), compared to income from operations of RMB724 million in the same period in 2018 and RMB885 million in the previous quarter. Income from operations increased by 84% year-over-year in the second quarter of 2019. Excluding share-based compensation charges, non-GAAP income from operations was RMB1.7 billion (US$251 million), compared to RMB1.2 billion in the same period in 2018 and RMB1.4 billion in the previous quarter. Non-GAAP income from operations increased by 43% year-over-year in the second quarter of 2019.

Operating margin was 15% for the second quarter of 2019, compared to 10% in the same period in 2018, and 11% in the previous quarter. Excluding share-based compensation charges, non-GAAP operating margin was 20%, compared to 16% in the same period in 2018 and 17% in the previous quarter.

Net loss attributable to Ctrip's shareholders for the second quarter of 2019 was RMB403 million (US$59 million), compared to net income attributable to Ctrip's shareholders of RMB2.4 billion in the same period in 2018 and RMB4.6 billion in the previous quarter, mainly due to the RMB1.3 billion loss from fair value changes in equity securities investments. Excluding share-based compensation charges and fair value changes of equity securities investments, non-GAAP net income attributable to Ctrip's shareholders was RMB1.3 billion (US$193 million), compared to RMB1.1 billion in the same period in 2018 and RMB1.8 billion in the previous quarter.

As of June 30, 2019, the balance of cash and cash equivalents, restricted cash, short-term investment, held to maturity time deposit and financial products was RMB67.8 billion (US$9.9 billion).

Business Outlook

For the third quarter of 2019, the Company expects the net revenue growth to continue at a year-over-year rate of approximately 10%-15%. This forecast reflects Ctrip's current and preliminary view, which is subject to change.