Zhejiang New Century Hotel Management reported that its revenue for 2019 rose 7.2% to RMB1,928.0 million and that its EBITDA climbed 144.1% to RMB741.9 million. Gross profit was RMB565.0 million, up by 20.7%. Net profit was RMB205.0 million, 8.4% more than the previous year.

The Chinese hotelier which is invested by Trip.com Group said earlier that it suspended operations at five properties for 38 days due to the coronavirus, causing a downward adjustment of the base rent by RMB 20.77 million in aggregate from RMB 200.00 million to RMB 179.23 million.

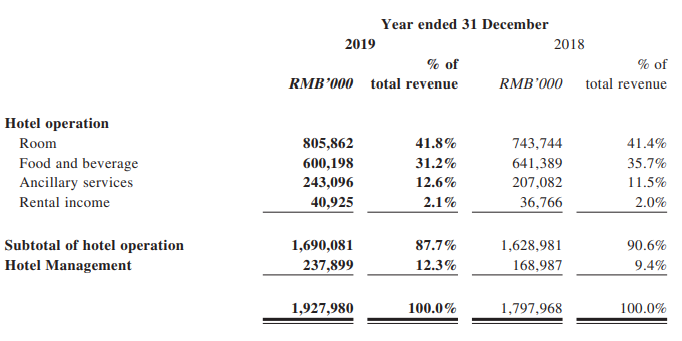

Revenue from hotel operation increased from nearly RMB 1629 million to RMB 1690 million last year, and Revenue from hotel management rose from RMB 169 million to RMB 238 million.

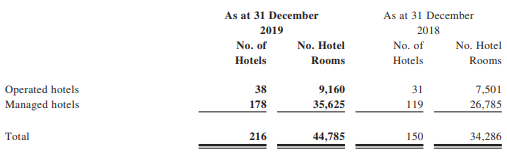

As of 31 December 2019, the company had totally 216 hotels, of which 38 were operated and 178 were managed.

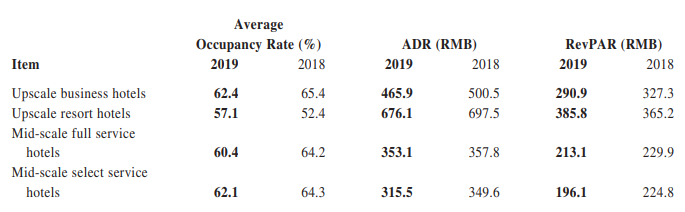

During the reporting period, RevPar for upscale business hotels rose from RMB 327.3 in 2018 to RMB 290.9, while RevPar for upscale resort hotels climbed from RMB 365.2 in 2018 to RMB 385.8.

Upscale resort hotels benefit from the maturity of hotels that were opened in 2018, and its occupancy rate in 2019 improved, driving the overall single room revenue of the product line.

However, other product lines were affected by the slower start-up period of newly added hotels which had commenced operations in a year that saw declining prosperity in some cities, leading to the decline in occupancy rates and ADRs.

In face of the COVID-19 virus, the hotel firm said it has "sufficient financial resources" to deal with the adverse effects caused by the Epidemic. The company aims to become a leading upscale hotel group in China with strong brand recognition.

New Century Hotel also disclosed the utilization of the net proceeds from the Global Offering from the Listing up to 30 June 2019. Some 25.0% will be used for the development of upscale business and resort hotels and 35.0% will be used for the development of mid-scale hotels.

As of 31 December 2019, the company’s total balance of cash and cash equivalents amounted to RMB345.7 million.