Huazhu Group announced its unaudited financial results for the fourth quarter and full-year ended December 31, 2019.

A total of 5,618 hotels or 536,876 hotel rooms in operation as of December 31, 2019.

Hotel turnover increased 21% year-over-year to RMB9 billion for the fourth quarter and increased by 19% to RMB35 billion for the full year of 2019.

Net revenues increased 8.5% year-over-year to RMB2.9 billion (US$418 million) for the fourth quarter, and increased 11.4% to RMB11.2 billion (US$1.6 billion) for the full year of 2019, in line with revenue guidance previously announced of 10% to 12%.

EBITDA (non-GAAP) for the fourth quarter of 2019 was RMB1.1 billion (US$152 million), compared with negative RMB46 million for the fourth quarter of 2018. EBITDA (non-GAAP) increased 56.5% to RMB3.6 billion (US$510 million) for the full year of 2019.

Excluding share-based compensation expenses and unrealized gains (losses) from fair value changes of equity securities, adjusted EBITDA (non-GAAP) for the fourth quarter increased 15.9% year-over-year to RMB854 million (US$122 million) and increased 2.4% to RMB3.3 billion (US$481 million) for the full year of 2019.

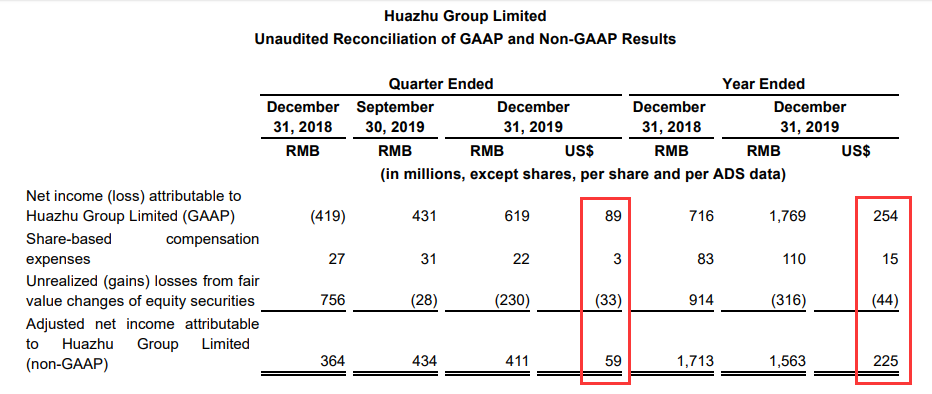

Net income attributable to Huazhu Group Limited was RMB619 million (US$89 million) for the fourth quarter of 2019, compared with net loss attributable to Huazhu Group Limited of RMB419 million in the fourth quarter of 2018 and net income attributable to Huazhu Group Limited of RMB431 million in the previous quarter. Net income attributable to Huazhu Group Limited increased 147.1% to RMB1.8 billion (US$254 million) for the full year of 2019.

Excluding share-based compensation expenses and unrealized gains (losses) from fair value changes of equity securities, adjusted net income (non-GAAP) for the fourth quarter of 2019 was RMB411 million (US$59 million), compared with RMB364 million for the fourth quarter of 2018, and adjusted net income (non-GAAP) for the full year of 2019 was RMB1.6 billion (US$225 million), compared with RMB1.7 billion for the full year of 2018. Huazhu completed the acquisition of Deutsche Hospitality on January 2, 2020

Fourth Quarter of 2019 Operational Highlights

During the fourth quarter of 2019, Huazhu opened 630 hotels, including 11 leased (“leased-and-operated”) hotels and 619 manachised (“franchised-and-managed”) hotels and franchised hotels.

The Company closed a total of 163 hotels, which included 20 leased hotels and 143 manachised and franchised hotels, during the fourth quarter of 2019. This was mainly due to three reasons:

a) With strategic focus to upgrade product and service quality, Huazhu temporarily closed 56 hotels for brand upgrade and business model change purposes; and removed 42 hotels for non-compliance with Huazhu’s brand and operating standards.

b) Property-related issues, including rezoning and expiry of leases, which resulted in the closure of 33 hotels.

c) 32 manachised hotels were closed due to operating losses.

The ADR, which is defined as the average daily rate for all hotels in operation, was RMB232 in the fourth quarter of 2019, compared with RMB230 in the fourth quarter of 2018 and RMB245 in the previous quarter. The year-over-year increase of 0.9% was primarily due to an increase in the proportion of mid- and up-scale hotels with higher ADR in the Company’s brand mix. The sequential decrease resulted mainly from seasonality.

The occupancy rate for all hotels in operation was 82.2% in the fourth quarter of 2019, compared with 85.2% in the fourth quarter of 2018 and 87.7% in the previous quarter. The year-over-year decrease of 3.0 percentage points was due to the soft macro economy and a dilutive impact from newly-opened hotels. The sequential decrease resulted mainly from seasonality.

Blended RevPAR, defined as revenue per available room for all hotels in operation, was RMB191 in the fourth quarter of 2019, compared with RMB196 in the fourth quarter of 2018 and RMB215 in the previous quarter. The year-over-year decrease of 2.7% was mainly attributable to the soft macroeconomy. Excluding our soft brands (Hi Inn, Elan, Starway, Madison and Grand Madison), the blended RevPAR for the fourth quarter of 2019 would have declined by 0.5% year-over-year. The sequential decrease resulted mainly from seasonality.

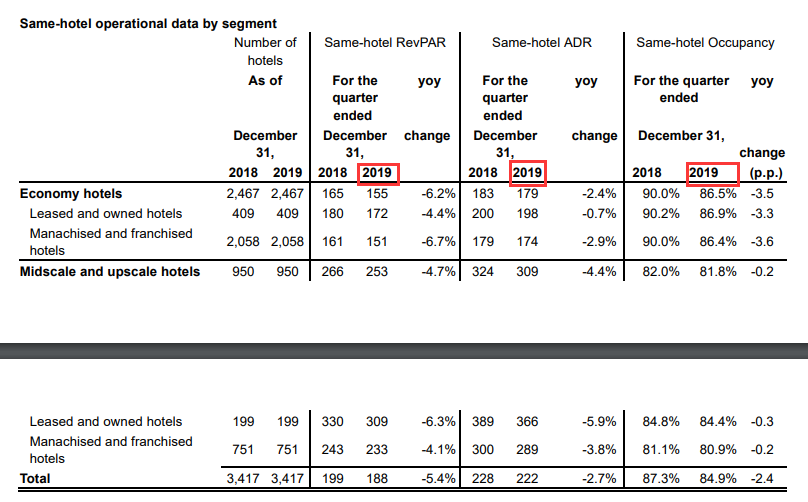

For all hotels which had been in operation for at least 18 months, the same-hotel RevPAR was RMB188 for the fourth quarter of 2019, representing a 5.4% decrease from RMB199 for the fourth quarter of 2018, with a 2.7% decrease in ADR and a 2.4-percentage-point decrease in occupancy rate. The year-over-year decrease was mainly due to macroeconomic softness and more promotions.

Operational Highlights of full-year 2019

For the full year of 2019, the company opened 43 leased hotels and 1,672 manachised hotels and franchised hotels and closed 54 leased hotels and 273 manachised and franchised hotels. As of December 31, 2019, the Company had 688 leased and owned hotels, 4,519 manachised hotels, and 411 franchised hotels in operation in 437 cities in China and Singapore. The number of hotel rooms in operation totaled 536,876, an increase of 27.0% from a year ago.

As of December 31, 2019, the Company had a total number of 2,262 hotels contracted or under construction, including 43 leased hotels and 2,219 manachised and franchised hotels. The pipeline represented 40% of the number of hotels in operation as the end of 2019.

For the full year of 2019, the ADR for all hotels in operation was RMB234, increasing 3.6% year-over-year from RMB226 in 2018. The occupancy rate for all hotels in operation was 84.4%, compared with 87.3% in 2018. As a result, the blended RevPAR for all hotels in operation was RMB198 in 2019, a 0.1% increase from RMB197 in 2018. Excluding our soft brands, the blended RevPAR for 2019 would have increased by 0.8% year-over-year.

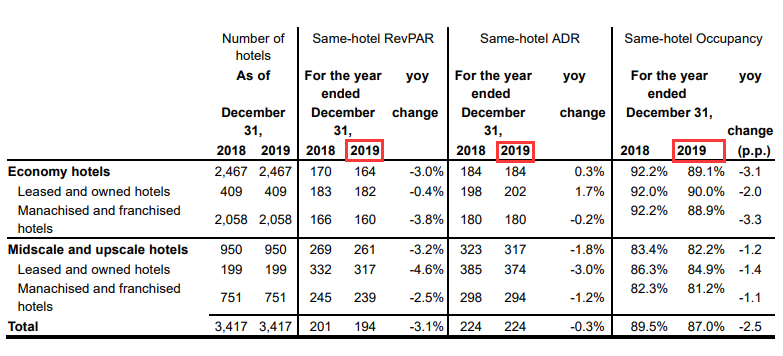

The same-hotel RevPAR was RMB194 in 2019, a 3.1% decrease from RMB201 in 2018, with a 0.3% decrease in ADR and a 2.5-percentage-point decrease in occupancy rate. In 2019, the economy hotels and the midscale and upscale hotels posted decreases of 3.0% and 3.2% in same-hotel RevPAR, respectively.

As of December 31, 2019, H Rewards (Huazhu’s loyalty program) had approximately 153 million members, who contributed approximately 76% of room nights sold during the full year of 2019 and approximately 85% of room nights were sold through the Company’s own direct channels.

Ji Qi, founder, Executive Chairman and CEO of Huazhu commented: “We concluded 2019 with strong hotel openings and pipeline against a challenging macroeconomic background. Thanks to our dedicated employees, our powerful brand portfolio and solid execution, we have further expanded our market share and achieved remarkable operational results.”

“Looking into 2020, the COVID-19 outbreak has been a major public health emergency in China and worldwide. Our top priority is the health and safety of our employees and customers, and the operational sustainability of our hotels. Since the start of the outbreak in China, we have set up a crisis task force comprised of a centralized command center, supported by 18 regional sub-command centers.

This task force communicates on a daily basis to mobilize all available resources and co-ordinate efforts from all parties from within and outside the Huazhu network. The objectives are to keep our employees and customers safe, keep providing emergency supplies to all our hotels, and to keep our hotels open to our customers. In addition, we are leveraging our internal information platform, a work app called H-Tone™, to communicate and organize our collaborative efforts so that our employees and franchisees have timely access to critical information at their fingertips. Now, we have moved to the initial recovery stage and are seeing gradual improvements in our hotel operations. Thanks to our well-established operational platform and multi-channel online and offline sales efforts, we maintain our leading position and outperformed our peers in the hotel industry.”

“Despite this temporary challenge and disruption to our business, as the industry leader, we remain confident about the long-term growth potential of China’s lodging industry and we will capture this opportunity to further consolidate the hotel industry. Huazhu will focus on our product qualities, innovative technology applications and organizational capabilities, and will strive to become a world-class hotel network.” Mr. Ji added.

Fourth Quarter and Full Year of 2019 Financial Results

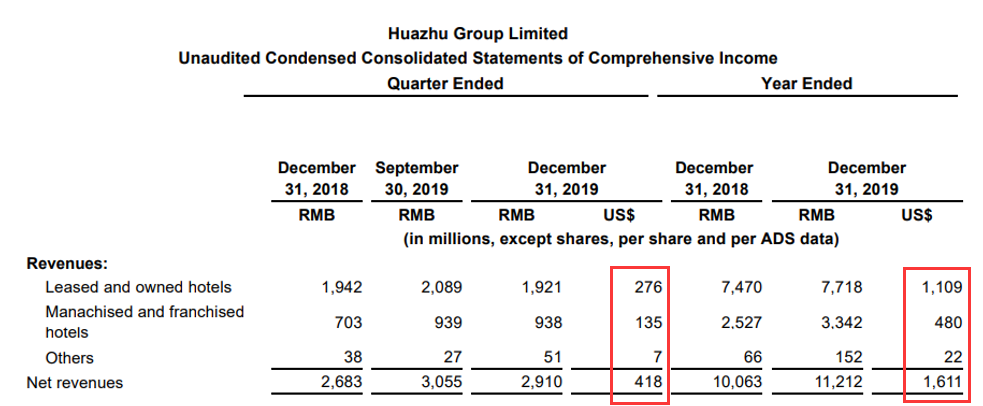

Net revenues for the fourth quarter of 2019 were RMB2.9 billion (US$418 million), representing an 8.5% year-over-year increase and a 4.7% sequential decrease. The year-over-year increase was primarily attributable to our hotel network expansion; the sequential decrease was due to seasonality.

Net revenues for the full year of 2019 were RMB11.2 billion (US$1.6 billion), representing an increase of 11.4% from the full year of 2018. Net revenues from leased and owned hotels for the fourth quarter of 2019 were RMB1.9 billion (US$276 million), representing a 1.1% year-over-year decrease and an 8.0% sequential decrease. The year-over-year decrease was mainly due to the decrease in RevPAR mainly caused by macroeconomic softness and the decrease in number of hotels in operation mainly caused by temporary hotel closures as product and brand upgrades were implemented. For the full year of 2019, net revenues from leased and owned hotels were RMB7.7 billion (US$1.1 billion), representing a 3.3% year-over-year increase.

Net revenues from manachised and franchised hotels for the fourth quarter of 2019 were RMB938 million (US$135 million), representing a 33.4% year-over-year increase and a 0.1% sequential decrease. For the full year of 2019, net revenues from manachised and franchised hotels were RMB3.3 billion (US$480 million), representing a 32.3% year-over-year increase. These hotels accounted for 29.8% of net revenues, compared to 25.1% of net revenues for the full year of 2018.

As of December 31, 2019, the Company had a total balance of cash and cash equivalents of RMB3.2 billion (US$465 million and restricted cash of RMB10.8 billion (US$1.5 billion). The restricted cash balance mainly comprised of cash reserved for the acquisition of Deutsche Hospitality totaling approximately US$800 million, cash reserved for the refinancing of syndication loan US$500 million, and US$220 million of cash pledged for certain bank borrowings.

Due to the impact of COVID-19, Huazhu now anticipates the gross opening of 1,600-1,800 hotels in 2020. In 2020, Huazhu is expected to close 350-450 hotels, including planned closure of 300-350 hotels and special closure of 50-100 hotels impacted by COVID-19.

In the first quarter of 2020, Huazhu expects net revenues to decline 15% to 20% year-over-year or 45% to 50% if excluding the addition of Deutsche Hospitality.

Read Original Report