Meituan Dianping today announced the audited consolidated results of the Company for the year ended December 31, 2019.

Financial Highlights

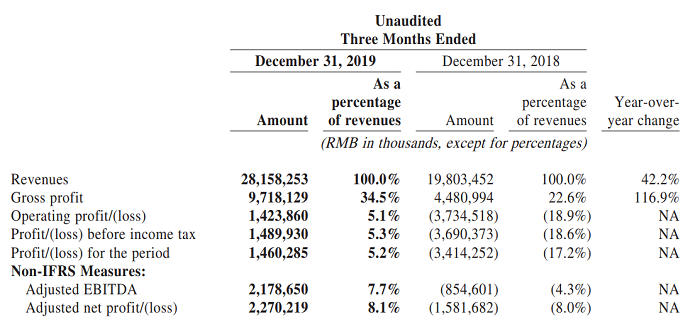

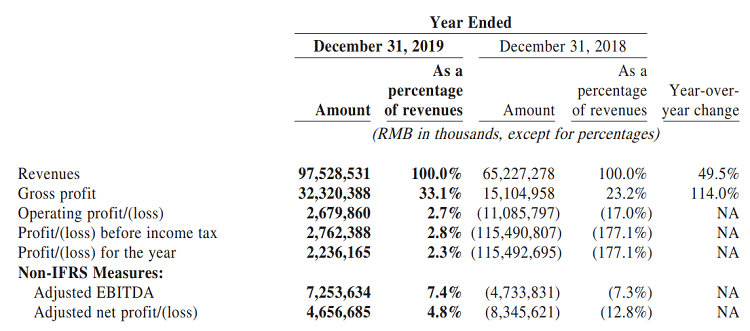

Total revenues increased by 49.5% year-over-year to RMB97.5 billion from RMB65.2 billion in 2018.

Total gross profit increased by 114.0% year-over-year to RMB32.3 billion from RMB15.1 billion in 2018, and operating profit turned to positive RMB2.7 billion from negative RMB11.1 billion in 2018.

Adjusted EBITDA and adjusted net profit were RMB7.3 billion and RMB4.7 billion in 2019, respectively.

Operating cash flow turned to positive RMB5.6 billion in 2019 from negative RMB9.2 billion in 2018. The company had cash and cash equivalents of RMB13.4 billion and short-term investments of RMB49.4 billion as of December 31, 2019, compared to the balance of RMB17.0 billion and RMB41.8 billion, respectively, as of December 31, 2018.

In-store, hotel & travel

In-store, hotel & travel businesses continued to solidify its market leadership and further demonstrated strong monetization capability in 2019. GTV of in-store, hotel & travel businesses grew by 25.6% year-over-year to RMB222.1 billion in 2019. Revenues from in-store, hotel & travel businesses increased by 40.6% year-over-year to RMB22.3 billion in 2019.

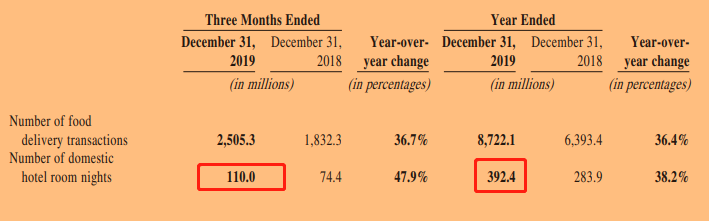

The Tencent-invested lifestyle services provider recorded 110 million domestic hotel room nights in the fourth quarter, up by 74.4%. Total hotel room nights for the year increased 38.2% to 392.4 million in 2019.

Gross profit of in-store, hotel & travel businesses increased by 40.1% year-over-year to RMB19.7 billion in 2019, while gross margin remained relatively flat year-over-year. GTV growth of in-store, hotel & travel businesses continued to accelerate for the fourth quarter of 2019, growing by 35.3% year-over-year to RMB60.4 billion.

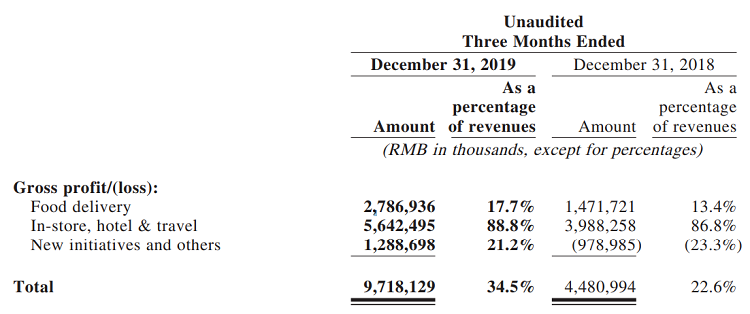

Revenues from in-store, hotel & travel businesses increased by 38.4% year-over-year to RMB6.4 billion for the fourth quarter of 2019. Gross profit from in-store, hotel & travel businesses increased to RMB5.6 billion for the fourth quarter of 2019, while gross margin increased to 88.8% from 86.8% year-over-year.

For in-store business, the year-over-year growth rate of commission revenues from transaction-based products re-accelerated in the beginning of the second half of 2019 and continued to accelerate during the fourth quarter of 2019.

Online marketing revenues also maintained strong growth momentum throughout the year, with around 55% increase year-over-year in 2019. The impressive results achieved in 2019 were mainly due to the refinement in business operations, strengthened content creation capabilities, expansion in the range of product and service offerings and enhanced location-based algorithms.

New initiatives and others

Revenues from the new initiatives and others segment increased by 81.5% year-over-year to RMB20.4 billion in 2019. Gross profit of the new initiatives and others segment increased to positive RMB2.3 billion in 2019 from negative RMB4.3 billion in 2018, while gross margin improved to positive 11.5% in 2019 from negative 37.9% in 2018. In the fourth quarter of 2019, revenues in this segment increased by 44.8% year-over-year to RMB6.1 billion in 2019. Gross profit increased to positive RMB1.3 billion in 2019 from negative RMB1.0 billion in 2018, while gross margin further expanded to positive 21.2% in 2019 from negative 23.3% in 2018.

Company outlook for 2020 and potential adverse impact of the recent coronavirus outbreak

Since the beginning of 2020, the coronavirus outbreak has resulted in tremendous near-term shocks to many industries in China. Local services, which are the focus of e-commerce platform, have been impacted by this pandemic in many ways. Especially, the pandemic has already caused severe disruptions to the daily operations of merchants, including restaurants, local services merchants and hotels, which in turn resulted in downward pressure on own operations for the first quarter of 2020. Business segments such as food delivery and in-store, hotel and travel are all facing significant challenges on the demand side and supply side. As a result of the pandemic, the company estimate that the company would experience negative year-over-year revenues growth and operating loss for the first quarter of 2020. Due to the high uncertainty of the evolving situation, the company is unable to fully ascertain the expected impact on full-year 2020 at this stage; however, if it takes longer for user demand and merchant operations to recover to normal levels as the pandemic continues, the results of operations for the following quarters could also be adversely impacted.

Although many businesses would be adversely impacted by the pandemic in 2020, the company believes that many industries will re-accelerate towards a better direction in the long run. The pandemic has also made the society more aware of the urgency and importance of digitizing the service industry on both the demand and supply sides. As the leading e-commerce platform for services, the company will be an important promoter, leader and long-term beneficiary of this long-term trend. In 2020, the company will continue to execute “Food + Platform” strategy and fulfill mission of “We help people eat better, live better”. The company will live up to the challenges throughout this pandemic, create more value for consumers and merchants, enhance consumer stickiness and deepen merchant relationships. Meanwhile, the company will continue to actively invest in the areas in ecosystem that the company believe will drive the growth of business, including merchants, consumers, delivery network, and technology.

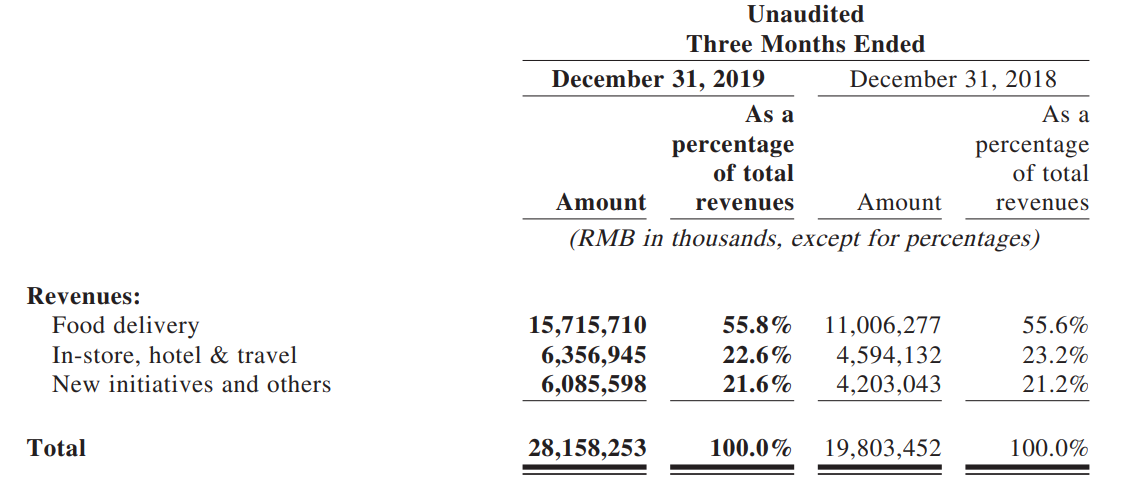

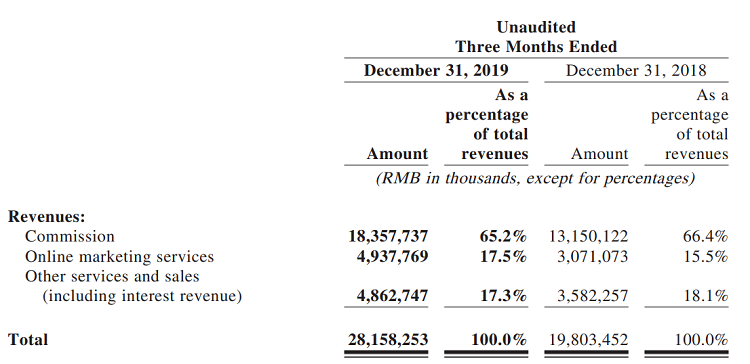

Revenues

Revenues increased by 42.2% to RMB28.2 billion for the fourth quarter of 2019 from RMB19.8 billion in the same period of 2018. The increase was primarily driven by the increase in Gross Transaction Volume on the company's platform to RMB189.9 billion for the fourth quarter of 2019 from RMB138.0 billion in the same period of 2018, which was driven by the increase in the number of Transacting Users, their purchase frequency and average order value, and the increase in Monetization Rate to 14.8% for the fourth quarter of 2019 from 14.3% in the same period of 2018.

Revenues from the in-store, hotel & travel segment increased by 38.4% to RMB6.4 billion for the fourth quarter of 2019 from RMB4.6 billion for the same period of 2018, primarily due to the increases in the number of Active Merchants and the average revenue per Active Merchant of in-store and travel businesses, and the increase in the number of domestic room nights consumed on the platform. Revenues from the new initiatives and others segment increased by 44.8% to RMB6.1 billion for the fourth quarter of 2019 from RMB4.2 billion for the same period of 2018, primarily due to the increases in the revenues from the B2B food distribution services, microloan business, Meituan Instashopping and integrated payment services, partly offset by the decrease in the revenues from car-hailing services.

Commission revenues increased by 39.6% to RMB18.4 billion for the fourth quarter of 2019 from RMB13.2 billion for the same period of 2018, primarily attributable to the substantial growth of GTV, especially from our food delivery business.

Online marketing services revenues increased by 60.8% to RMB4.9 billion for the fourth quarter of 2019 from RMB3.1 billion for the same period of 2018, primarily due to the increase in the number of online marketing Active Merchants.

Other services and sales revenues increased by 35.7% to RMB4.9 billion for the fourth quarter of 2019 from RMB3.6 billion for the same period of 2018, primarily due to the growth of revenues from B2B food distribution services and microloan business, partially offset by the decrease in the revenues from car-hailing services.

Cost of revenues increased by 20.3% to RMB18.4 billion for the fourth quarter of 2019 from RMB15.3 billion in the same period of 2018, primarily attributable to the increase in food delivery rider costs as a result of the increase in the number of food deliveries completed.

As a result of the foregoing, gross profit for the fourth quarter of 2019 and 2018 was RMB9.7 billion and RMB4.5 billion, respectively. The gross margin of in-store, hotel & travel businesses increased by 2.0 points on a year-over-year basis, primarily attributable to economy of scale of hotel booking business. The gross margin of new initiatives and others businesses turned to positive 21.2% for the fourth quarter of 2019, representing an improvement of 44.5 points on a year-over-year basis.

Read Original Report