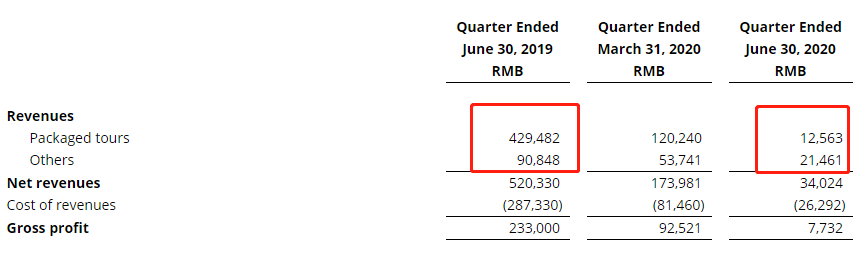

Leisure-focused Chinese online travel company Tuniu Corporation said its revenue from packaged tours declined more than 97% year-over-year in the second quarter this year.

Tuniu said the decrease was primarily due to the negative impact of COVID-19. In January, the Chinese government issued a notice requiring travel agencies, including OTAs throughout the country to suspend the operation of organized tours and the provision of a combination of flight and hotel bookings.

Tuniu's total net revenues were RMB 34.0 million (USD 4.8 million) for the quarter, down by 93.5% from the same quarter last year.

Gross margin was 22.7% in the second quarter of 2020, compared to a gross margin of 44.8% in the second quarter of 2019.

Net loss was RMB 154.6 million (USD 21.9 million) in the quarter, compared to a net loss of RMB 167.2 million in the second quarter of 2019.

As of June 30, 2020, the company had cash and cash equivalents, restricted cash and short-term investments of RMB 1.6 billion (USD 225.2 million).

Tuniu believes that its current cash, cash equivalents and maturity of investments will be sufficient to meet the company's working capital requirements and capital expenditures in the ordinary course of business for the next twelve months.

Donald Dunde Yu, Tuniu's founder, Chairman and Chief Executive Officer, said that after nearly six months of downturn caused by COVID-19, the company is encouraged to see that China's domestic travel market is finally showing signs of recovery.

"In the second quarter our operating expenses continued to decline on a sequential basis. In the second half of the year, we expect to see the gradual recovery of revenues alongside the increasingly positive impact of our cost control measures."

Tuniu projects that the negative impact of COVID-19 will continue in the third quarter. The company expects to generate RMB 85.3-170.5 million (USD 12.4-24.8 million) in net revenues, which represents an 80%-90% decrease year-over-year, and 151% to 401% increase quarter-over-quarter.