Chinese hotel chain Huazhu Group said its net revenues rose 3.4% year-over-year to RMB 3.2 billion (USD 466 million) in the third quarter this year, better than revenue guidance previously announced of 0%-2% increase.

Hotel turnover increased 7% year-over-year to RMB 11 billion for the quarter. Excluding DH (Deutsche Hospitality), hotel turnover decreased 1%.

As of the end of September, the company had 6,507 hotels or 634,087 hotel rooms in operation and 2,313 unopened hotels in pipeline.

Huazhu recorded a net loss of RMB 212 million (USD 31 million) during the quarter, while last year it saw a net income of RMB 431 million in the third quarter.

Excluding DH, net income was RMB 482 million for the third quarter of 2020.

Legacy Huazhu highlights

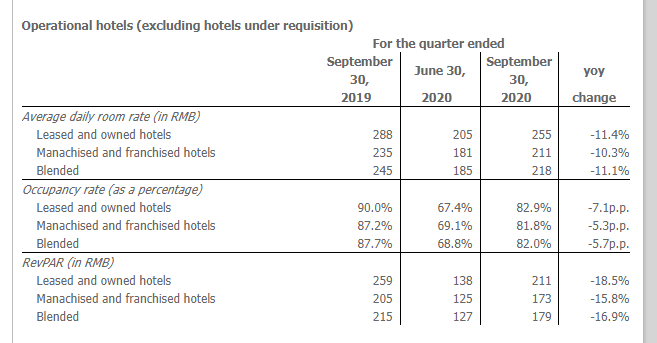

Occupancy rate for all hotels in operation was 82.0% in the third quarter of 2020, compared with 87.7% in the third quarter of 2019 and 68.8% in the previous quarter.

Blended RevPAR was RMB 179 in the third quarter of 2020, compared with RMB 215 in the third quarter of 2019 and RMB 127 in the previous quarter.

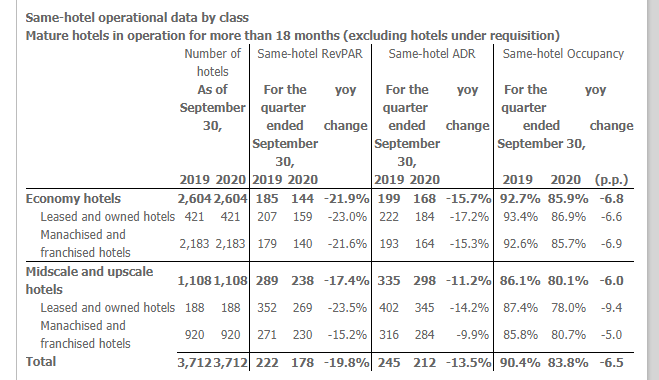

For all hotels which had been in operation for at least 18 months, the same-hotel RevPAR was RMB 178 for the third quarter of 2020, representing a 19.8% decrease from RMB 222 for the third quarter of 2019, with a 13.5% decrease in ADR and a 6.5-percentage-point decrease in occupancy rate.

Legacy DH highlights

Occupancy rate for all Legacy-DH hotels in operation was 37.9% in the third quarter of 2020, compared with 75.7% in the third quarter of 2019 and 18.3% in the previous quarter.

Blended RevPAR was EUR 35 in the third quarter of 2020, compared with EUR 74 in the third quarter of 2019 and EUR 16 in the previous quarter.

Qi Ji, Founder, Executive Chairman and CEO of Huazhu commented: "We are pleased to see our adjusted EBITDA turned to a positive at RMB184 million in third quarter from a loss of RMB97 million in second quarter 2020, mainly due to continued strong recovery of Legacy-Huazhu’s hotels during the third quarter, following an upward RevPAR trend."

Mr. Ji remains very confident to achieve the target of 10,000 hotels by 2022. "...we believe the pandemic will accelerate the industry consolidation where Huazhu, as one of the market leaders, should be the major beneficiary." Huazhu is also exploring new opportunities in lower-tier cities to further expand across China.

As of September 30, 2020, the company had a total balance of cash and cash equivalents of RMB 6.6 billion (USD 969 million) and restricted cash of RMB 1.3 billion (USD 195 million).

Guidance

In October and November, Huazhu's blended RevPAR recovered to around 100% and more than 90% of last year level, respectively. For December, up to the date of this release, the company has not yet seen any major impacts on blended RevPAR from recent recurrence of COVID-19 outbreak in various cities, such as Shanghai and Tianjin.

In the fourth quarter of 2020, Huazhu expects net revenues to increase by 0%-3% year-over-year, or to range from a decline of 4-7% if excluding the addition of DH.