Zhejiang New Century Hotel, a high-end hotel chain invested by Trip.com Group, announced on January 20 that it has received a voluntary privatization offer from an affiliated company of Sequoia China and Ocean Link.

According to a joint announcement, the board of New Century Hotel received a letter on January 18 from the offeror Kunpeng Asia Limited, a Hong Kong-incorporated firm controled by Sequoia China and Ocean Link. Kunpeng Asia plans to buy New Century Hotel's H Shares and Domestic Shares.

The offeror proposed to pay HK$ 1.51 billion in the deal that valued New Century Hotel at HK$ 5.2 billion (USD 670 million), according to a Bloomberg report. The offer represents a 24.7% premium to the last closing price in Hong Kong.

Ocean Link is a private equity firm with a focus on China’s consumer, travel and TMT sectors. Ocean Link currently manages two USD funds and an RMB Fund. Ocean Link’s strategic partners include Trip.com Group – the largest online travel agency in China, and General Atlantic – a leading global growth equity firm. The funds’ LPs include Chinese and global corporates, financial institutions, sovereign wealth funds and family offices.

Trip.com Group chairman James Liang is a board director of Ocean Link.

If implemented, the privatization offer will result in the delisting of New Century Hotel from the Hong Kong Stock Exchange, where the hotel chain had its IPO less than two years ago.

In March 2019, New Century Hotel got listed on the Hong Kong Stock Exchange with Trip.com Group (Ctrip) and GreenTree Hospitality as its cornerstone investors.

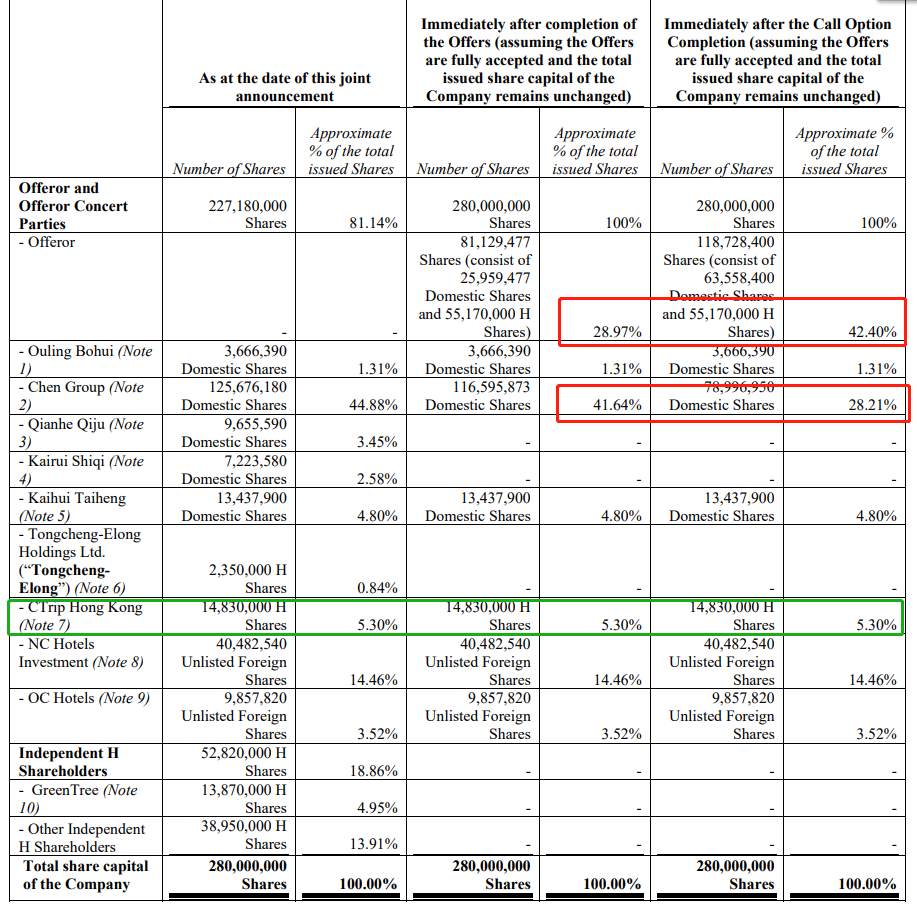

According to the joint announcement on the privatization offer, Trip.com Group will continue to own a 5.3% stake in New Century Hotel after completion of the offer and after the call option completion.

The offeror will control a 28.97 stake after completion of the offer, and a 42.4% after the call option completion.

Chen Group, a major shareholder of the hotel chain, will see its stakeholding decrease from 44.88% to 41.64% after completion of the offer, and 28.21% after the call option completion.