US-based infrastructure and engineering company AECOM has shared its views on the development of theme parks in China in the post-pandemic era.

Industry evolution has been accelerated and the market is being reshaped

Driven by people’s increasing demand for recreation and greater consumption power, the theme park market remains vibrant. Despite Covid-19, the total number of theme parks in China has increased to 156, including those that are temporarily closed and face uncertainties in future development.

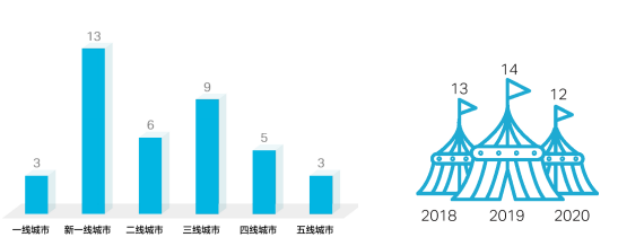

Among the 39 theme parks built in 2018-2020, one third of them are located in emerging cities such as Nanjing and Zhengzhou. The coronavirus outbreak had no doubt set back the opening schedule in 2020, but with the recovery of China’s domestic market, 12 theme parks opened last year, matching the number of newly opened parks in the previous two years.

AECOM also noted that about 20 of the theme parks it tracked over the past three years had closed, 70%-80% of which had less than RMB 1 billion (USD 154.8 million) startup capital, no specific themes or rides, and performed weakly with no more than one million annual visitors. Covid-19 put the nail on the coffin of these less risk-resistant theme parks. They had to either suspend operation or regroup.

Some theme parks have shifted to an open operation model, allowing free entry but charge for individual entertainment programs or themed areas. About 30 theme parks in China, or 20% of the parks tracked by AECOM, have adopted this model.

Investors target at lower-tier cities

About 80 theme parks are scheduled to open between 2021 and 2025 in China. First-tier cities remain top choices for international theme park brands. Second- and third-tier cities are becoming popular sites among local Chinese brands. Cities in Yangtze River Delta and the Greater Bay Area are gathering momentum for theme park development and will appeal to investors in the next five years.

Universal Studios, Lego, Nickelodeon Universe and other world-renowned brands will invest in China, promoting their large-scale parks as growth engines for driving their host cities to become regional recreation centers. These brands will be more flexible in their choice of locations, looking beyond first-tier cities. Instead, the brands will make comprehensive analyses about market growth potentials in each region and develop portfolios accordingly.