Recently, Tencent-backed online travel company Tongcheng-Elong released a report on family travel in China in 2020 and related trends for the future.

According to the seventh national population census conducted last year, there were 253 million children aged 14 or below in China, equivalent to 17.95% of the population, 1.35 percentage points higher than in 2010.

The report pointed out that the increase in the number of children aged 14 or younger reflects the potential for the growth of family travel.

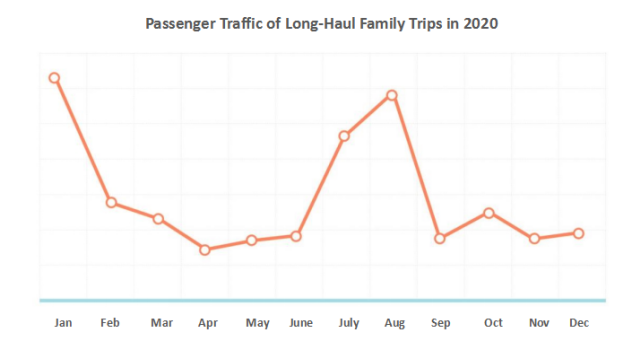

Summer was prime season for family travel

Flight booking data from Tongcheng-Elong showed that although long-haul trips catering for families with children aged 12 and younger declined 13.8% in 2020 compared to pre-Covid levels, long-haul family trips taken in July and August as well as January had shown peak demand.

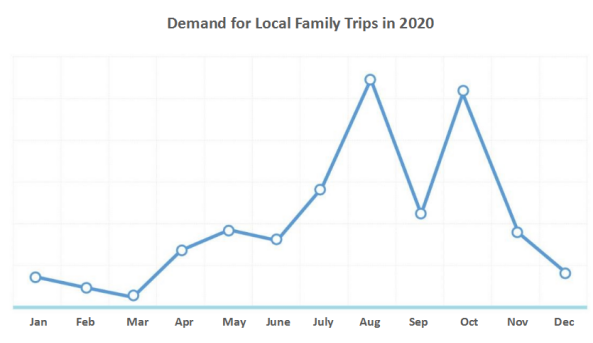

Local family trips had shown a similar trend. Despite the impact of the pandemic, local family trips started recovering since the second quarter of 2020 and peaked in August and October.

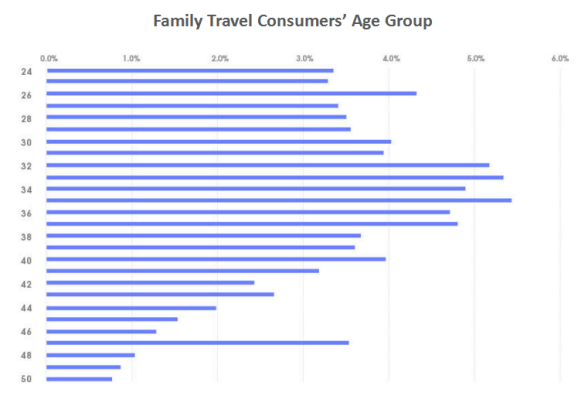

Post-80s and 90s emerged to be major force for family travel

Consumers born in the 1980s and 1990s (aged between 22 and 41) became the major force for family travel, accounting for 44.8% and 29.5% of the travelers. As a second child is allowed in the 1970s, there was a relatively high proportion of family travel in certain age segments in the age range of age 42 to 51.

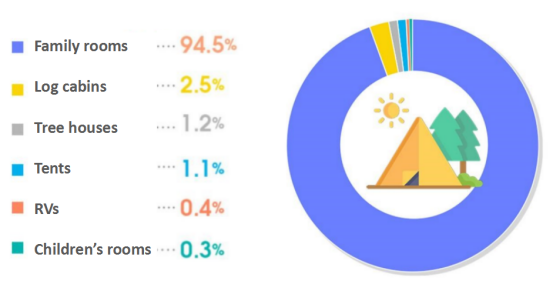

Travelers aged between 22 and 41 were more fashion and quality oriented, which also pushed the family travel market toward diversification and high quality. Tongcheng-Elong’s data showed that while typical family rooms in hotels remained the most popular accommodations, alternative accommodations such as log cabins, tree houses, tents and RVs were also gaining popularity.

In 2020, 94.5% of family travelers picked family rooms for accommodation, 2.5% chose log cabins, and tree houses and tents each captured more than 1% of the family travel market. Although alternative accommodation was just a very small part of the family trip market, it is growing rapidly.

Family travelers were much less price-sensitive for accommodation spending, and spent 20% more than other traveler groups on average.

Data from Trip.com showed that in the first half of this year, spending on family travel increased by 41% year on year. Other than theme parks, zoos, botanical gardens and other traditional venues, fun activities such as camping and concerts were also becoming popular choices for family trips.

In Shanghai, bookings for camping at local and short-haul destinations increased by 206% last year compared to the same period of 2019, with the number of campers rose 88% from 2019. Among family camping travelers, 70% of parents took their kids to camping at least twice. Camping venues in first- and second-tier cities accounted for over half of the total in China.

“2+1+X” / “2+2+X” became new patterns of family trips

In China, it’s typical that family travel involves one or two parent(s) taking the family’s only child. But with the increase of two-child families, a new pattern is emerging. The family u nit comprises two parents, one or two kids and grandparents to travel.

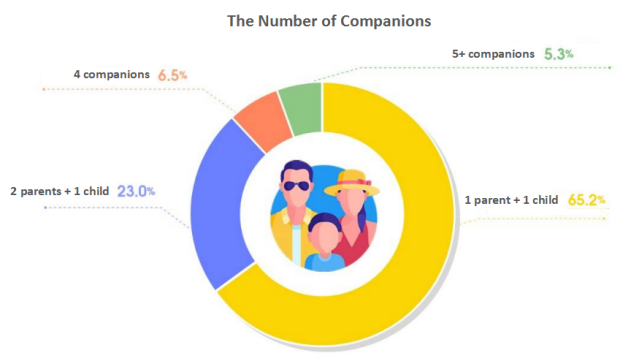

Despite such changes, “1 parent + 1 kid” units still dominated, accounting for 65.2% of family trips, followed by “2 parents + 1 kid”, which accounted for 23%.

In terms of destinations, cities with large-scale theme parks, museums, zoos and other high-quality tourist attractions drew the largest number of parents and children. Since last year, Shanghai, Beijing, Guangzhou, Xi’an, Hangzhou and Chengdu have been listed among the top 10 destinations.

The Tongcheng-Elong Research Institute estimated that with the steady recovery of domestic travel, family travel transaction volume would resume to above the 2019 level. The coming summer holiday will be a good indicator of the market’s pace of resumption.

The three-child policy will fuel the market

China announced on Monday that couples would be allowed to have up to three children, up from the current limit of two, in a bid to grow the population sustainably. Experts in the travel industry believe that the three-child policy will bring more opportunities for the family travel market.

Chaogong Cheng, a commentator of ChinaTravelNews parent TravelDaily.cn and the chief analyst of Tongcheng Research Institute, believed that the three-child policy would ensure a brighter prospect for China’s family travel market in the coming five years.

From 2015 to 2019, the CAGR of China’s domestic family travel transaction volume reached 32.9%, mainly driven by the policy launched in 2015 when the government allowed all couples to have up to two children, according to Tongcheng-Elong. Therefore, it’s expected that the three-child policy will further expand the family travel market.