Upscale hotels were opening at a slower pace, with 43.6% fewer newly opened hotels in China in the first quarter of 2022 compared to the previous quarter, due to the sporadic outbreaks of Covid-19 and tightened restriction measures, according to a report released by research firm Meadin Academy. The upside, though, is that domestic hotel brands were outpacing international brands in launching new upscale properties.

The report showed that a total of 31 upscale hotels and 7,293 rooms were added in the first quarter of 2022, up by 10.7% and 0.37% year on year, but down by 43.6% and 35.6% from the fourth quarter of 2021.

China’s eastern and southwestern regions claimed the lion’s share of new hotel supply, attracting 22 hotels (5,329 rooms) and 4 hotels (969 rooms) respectively, accounting for 71% and 12.9% of the total additions.

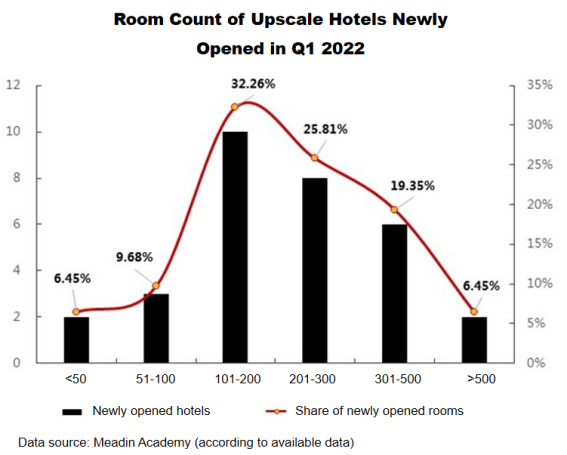

![]() Most of the new properties have 101 to 200 rooms, accounting for 32.3% of the total, followed by larger hotels with 201 to 300 rooms (25.8%) and those with 301 to 500 rooms (19.4%).

Most of the new properties have 101 to 200 rooms, accounting for 32.3% of the total, followed by larger hotels with 201 to 300 rooms (25.8%) and those with 301 to 500 rooms (19.4%).

The new properties belong to 27 hotels brands and 21 hotel groups. Over 67% of these hotels are under Chinese hotel brands, indicating local brands’ increasing popularity among property owners. Specifically, 21 of the hotels are with 15 domestic hotel groups and 17 hotel brands. Narada Hotels took the lead among all the hotel groups, adding four hotels to its portfolio, sharing the lead with Hilton Worldwide Holdings.

In terms of hotel rooms, 65.3% of the total, or 4,762 rooms, are under domestic hotel brands, twice as many as those under international brands.

Business hotels are the most popular type with 12 hotels, accounting for 38.7% of the total, followed by resort hotels (22.6%).