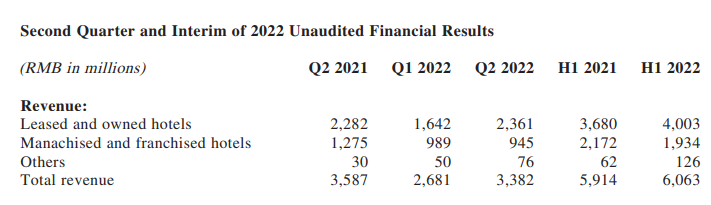

Chinese hotel giant H World (formerly Huazhu Group) said its revenue for the second quarter this year dropped 5.7% year-over-year to RMB 3.4 billion (USD 504 million). Revenue for Legacy-Huazhu excluding Steigenberger Hotels AG and its subsidiaries (DH) was down by 26.8%.

Hotel turnover decreased 10.3% year-over-year to RMB 11.8 billion in the second quarter.

The company had 8,176 hotels or 773,898 hotel rooms in operation as of June 30, 2022.

Net loss attributable to H World Group was RMB350 million (USD 52 million) in the second quarter of 2022, compared with net income attributable to H World Group Limited of RMB 378 million in the second quarter of 2021.

In the third quarter of 2022, H World expects revenue to increase 13% to 17% compared to the third quarter of 2021, or to increase 5% to 9% if excluding DH.

Jin Hui, CEO of H World commented:

"During the second quarter, a large-scale outbreak of the Omicron variant in China again significantly affected our China business, especially in April and May due to the extensive lockdowns in various cities. However, with a gradual lifting of the lockdowns since late May 2022, our RevPAR started to recover and improved to 86% of the 2019 level in June 2022, and further improved to 90% of the 2019 level in July 2022.

"Although COVID has been affecting our business from time to time over the last two-and-a-half years, our long-term strategy remains intact. In order to further increase our hotel coverage and penetration rate in China, we need to move our organization and management closer to the local market. Therefore, in the second quarter, we established six regional headquarters and shifted from brand-based to regional-based organizational structure for our economy and midscale brands. By doing so, we believe we can become even closer to our local customers, franchisees, and employees, and create more value for all of them in a more efficient, agile, and precise manner. Moreover, localized management and operational capabilities would achieve better regional synergy and result in higher operational efficiency.

"Different from the approach we adopted for the economy and midscale segments, we are keeping our brand-based organizational structure unchanged for our upper-midscale and upscale brands due to the importance of differentiated brand positioning and a unique customer experience for each of our upper-midscale and upscale brands.

"Lastly, as we mentioned before, we will no longer develop soft brands in the economy segment in the future. We will accelerate our exit from this particular segment through retiring our existing hotels in the next one to two years, thereby continuously enhancing the overall quality of hotels in our network. It also closely aligns with our long-term ‘Sustainable Quality Growth’ strategy.”