China's cruise market, one of the most dynamic sectors in the global travel industry, is witnessing mixed developments this year as the nation gradually recovers from the impact of Covid-19:

• Chinese-flagged ship “CM-Yidun”, a joint venture between Viking Cruises and China Merchants Group, set sail on June 18 from Shanghai to Japan for a 15-day journey. It was the first international cruise route departing from a Chinese port since the release of the Ministry of Transport's "Orderly Resumption Plan for International Cruise Transport."

• Switzerland-based MSC Cruises plans to kick off international cruises from the Chinese mainland next year with MSC Bellissima, sailing to neighboring countries between March 16 and April 24, 2024. The company is also introducing its high-end luxury brand Explora Journeys to the China market.

• British-American cruise operator Carnival Corp., however, will stay "on the sidelines" of the China market for a few years, according to the company's CEO Josh Weinstein. Carnival's Chinese joint venture with China State Shipbuilding Corp, CSSC Carnival, has changed its name to Adora Cruises, dropping the Carnival branding.

ChinaTravelNews recently had a conversation with Helen Huang, president of MSC Cruises China, to explore how China's cruise sector is recovering from the pandemic, and how international cruise brands are redeploying their resources to service this market in the next few years.

Pent-up demand amid economic slowdown

Global economic recovery post-pandemic is still unstable. The International Monetary Fund projects that world economic growth will fall from 3.5% in 2022 to 3.0% in both 2023 and 2024.

Yet consumer demand for travel and tourism is resilient. Ms. Huang observes huge pent-up demand for cruise travel. When MSC Cruises started to sell its 2024 world cruise route products in the summer of 2022, great sales figures from the China market were achieved, even before China reopened its border.

"The company resumed operation in August 2020, and by June 2022 the entire fleet was back in service," she mentioned. "In the second half of 2022, MSC Cruises' global booking volume and value had exceeded the pre-pandemic level."

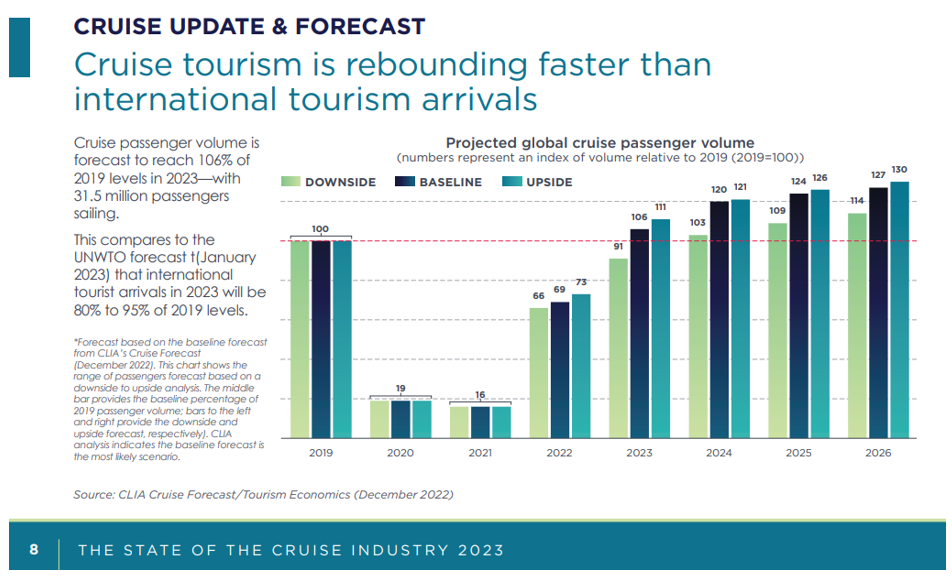

China's overall outbound travel market is still recovering slowly, partly due to bottlenecks in flight capacity and visa issuance. But global data suggests that cruise tourism might be rebounding faster than international travel.

According to the 2023 State of the Cruise Industry Report by the Cruise Lines International Association (CLIA), cruise passenger volume this year is forecast to reach 106% of the 2019 level — with 31.5 million passengers sailing in 2023, while the UNWTO forecast in January that international tourist arrivals in 2023 will be 80% to 95% of the 2019 levels.

Bringing in a new brand to China

Ms. Huang said that MSC Cruises grew from a fledgling startup to a world-leading cruise giant in two decades, now ranking as the top player in Europe, while expanding rapidly in the United States.

As the world's third-largest cruise brand by capacity trailing Royal Caribbean and Carnival Cruise, MSC Cruises is bullish about the China market.

"We see China as a strategically important market for the company's long-term future. The country has great potential for cruise tourism growth," she said. "China's population is aging. There is an increasing number of well-educated and financially secure individuals born in the 1960s and 1970s who are now retiring and have time and money for cruise travel."

The company offers products of Explora Journeys and the MSC Cruises brand under the same local team in China. EXPLORA I, the first ship to join the fleet of Explora Journeys, has commenced her maiden journey on August 1, for a seven-night sailing that will take guests through the majestic landscapes of Lerwick, Shetland Islands and Kirkwall, Orkney before heading to Reykjavik, Iceland.

Ms. Huang explained that Explora Journeys is a higher-end, more luxurious and more private brand than MSC Cruises' other ships such as MSC Virtuosa and MSC Bellissima. Explora aims to take its guests on deeper exploration, including on-shore tour experiences.

"An Explora ship has more than 400 lower berths (bed spaces). For each passenger on board, there will be almost one crew member serving that guest’s needs. This high level of staffing ensures that passengers receive personalized attention and enjoy a comfortable and relaxing cruise experience," Ms. Huang said.

"We believe that China has a huge base for high-end luxurious cruise consumers, and the demographic is younger than our international guests. Explora Journeys is positioned as a fashionable brand, catering to multi-generation family trips. We want to reach more first-time customers from the luxury hotel and resort consumer groups."

Innovations to attract young people

Traditional cruise guests are typically multi-generation family tourists and meeting and incentive travelers, accounting for more than 70% of MSC Cruises' guests, according to Ms. Huang.

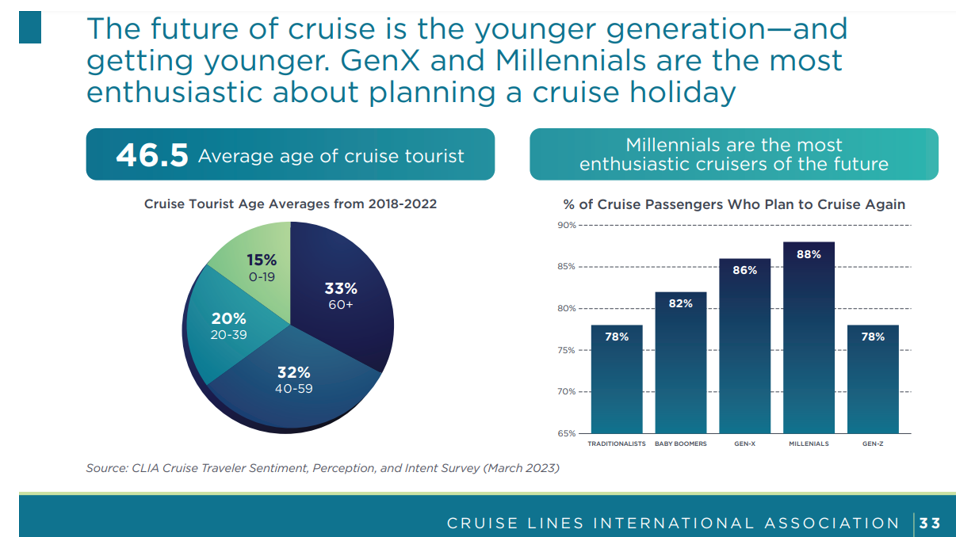

CLIA's report also shows that the bulk of the cruise tourists (65%) are over 39 years old. But younger generations are the future pillars for the cruise industry, with 88% of Millennials and 86% of Gen-X travelers who have cruised before saying they plan to cruise again.

Ms. Huang said the company sees great opportunities in luring younger guests with marketing and product innovations.

"Cruise companies can cater to young people's interests in new experiences and host group activities like music festivals on ships, or work with online influencers on social media to present cruise options in the inspiration stage of travel decision," she mentioned. For product innovation, Ms. Huang said they might offer weekend cruises, taking young guests from Shenzhen or Guangzhou to Hong Kong for an affordable and fresh experience.

MSC Cruises has also partnered with major sporting events to attract more customers.

The company has been a global partner of Formula 1 since 2022, offering unique Grand Prix hospitality experience on board its ships. It also worked with FIFA World Cup in Qatar last year, chartering three ships to serve as "floating hotels" in Doha.

Competition is beyond cruise

The landscape of China's cruise market is changing rapidly. Though Carnival, one of MSC Cruises' major competitors in the market, is backing off at least for a few years, a new local player has showed up: home-grown Chinese cruise line Adora Cruises has completed the maiden sea trial of its Magic City ship in July.

Ms. Huang believes that it's natural for Chinese cruise brands to enter the market as the market grows and matures. But she thinks the real competitors are on land.

"I think cruise lines are not competitors to each other. Instead, we should team up to compete for customers from hotels, resorts and flight+hotel vacation packages," she said. "Only with more cruise brands and more capacity available in the market can we grow the cruise industry collectively."

That said, Ms. Huang admitted that the Chinese cruise market is challenging for both international and local players. "With lots of uncertainty in the market, including geopolitical risks, we have to be very agile to respond, and adapt our business plans and sales models to the latest environment."

She explained that the cruise business is a global undertaking that requires careful planning and deployment. Cruise lines typically start selling their routes 18-24 months in advance of the departure date. This means that any change in market conditions can make it challenging to reallocate resources.

Building a broader industry chain

Despite all the challenges, Ms. Huang firmly believes that China's cruise market will most certainly grow for the next 10 years.

"Firstly, China has set up cruise ports from the north to the south, enabling cruise lines to operate multi-homeports in the market. Secondly, there is huge demand for cruise travel, particularly from the 'silver-haired generation', while market supply is somewhat limited since international cruise brands including Carnival are still holding back. We do not foresee a sudden increase in market supply in the short term.

"Thirdly, China's cruise industry is growing in both consumer service operation and the supply chain, including cruise ship procurement, talent recruitment, ship maintenance and even shipbuilding. That will create room for more comprehensive development for the cruise industry."