A global investment firm has unloaded its stake in Trip.com Group, as the Nasdaq-listed Chinese online travel giant’s stock price has reached a record high.

Dutch internet investment company Prosus has exited its position in Trip.com Group, cashing out approximately $1.6 billion. This move makes Prosus the latest international investor to reduce exposure to Chinese companies. According to Prosus’ official website, the company has sold 30 million Trip.com shares.

Back in 2019, Prosus exchanged its stake in MakeMyTrip for a 5.6% stake in Ctrip, now known as Trip.com Group.

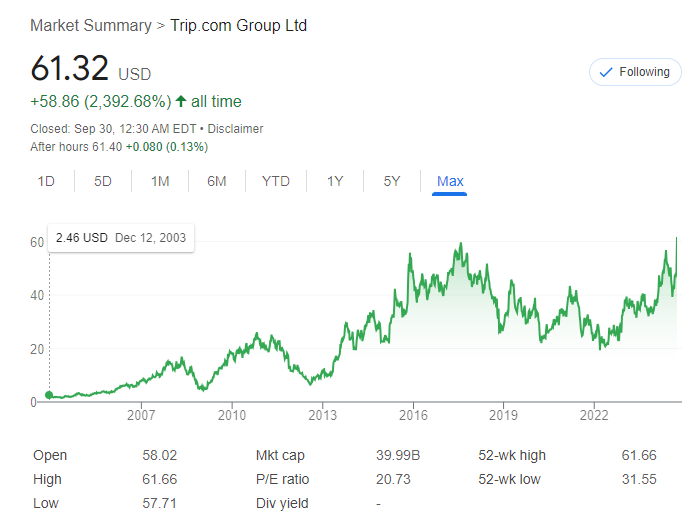

Prosus‘ decision to sell its Trip.com shares comes amid a surge in Trip.com Group’s stock price, which has reached its highest level in history.

The divestment aligns with a broader trend of foreign capital outflows from China. Bloomberg reported that international investors withdrew a record USD 15 billion from China in the second quarter this year.

Prosus is controlled by Naspers, is a South African multinational media conglomerate established in 1915. In 2001, MIH, a subsidiary of Prosus acquired a 46.5% stake in Tencent for USD 32 million, which has since grown into one of the most profitable investments in corporate history, valued at hundreds of billions of dollars over the past years.