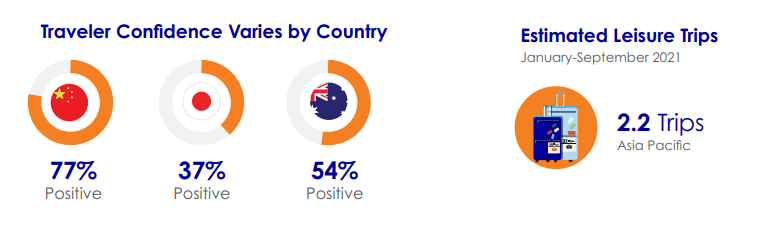

Global research by Expedia has found that Chinese travelers are more optimistic about travel in 2021 than travelers from other Asia Pacific countries, with more than three-fourths expressing positive sentiment, the highest across all 11 markets surveyed.

Japanese travelers need the most reassurance, as only one-third have a positive outlook, while Australian traveler confidence is more evenly split—1 in 2 are optimistic about future travel.

In the Asia Pacific markets of Japan, Thailand, Singapore, Australia, India, and Korea, domestic searches in December led in all markets, except Singapore, where international searches showed a slight edge over domestic, likely due to the green lanes and travel pass arrangements with partner countries.

Many of the rationales that drove travel in Asia Pacific during COVID-19 – such as needing a change of scenery, using vacation days, or visiting friends and family – will carry over to this year, according to the report.

* Instilling traveler confidence

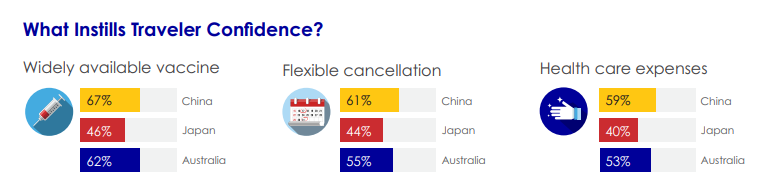

Various factors drive travel confidence across Asia Pacific, though travelers across the region agree that a widely available vaccine would make them more comfortable with travel: 67% in China, 62% in Australia and 46% in Japan.

Traveling with full cancellation and refunds on transportation (53%) and not having to worry about health care expenses or coverage while traveling (51%) can also help instill confidence among Asia Pacific travelers.

Marketers can help reassure travelers with content that highlights flexible booking and cancellation policies, while destinations offering free or discounted travel or health insurance for travelers should spotlight this information to help inspire and engage potential visitors.

* What influences travel decisions?

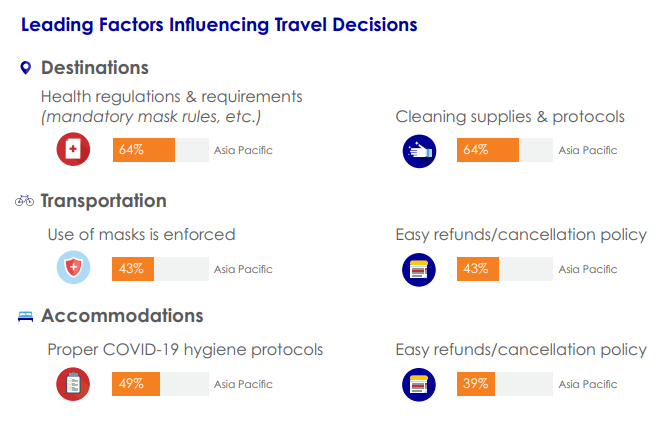

Health regulations and requirements, particularly mask enforcement and proper COVID-19 hygiene protocols, are the leading factors influencing destination, transportation, and accommodation decisions in Asia Pacific.

Mask use and enforcement is the leading factor influencing transportation decisions in Japan (51%) and China (42%), while budget considerations (54%) and refund or cancellation policies (50%) lead for Australian travelers.

* Influential content

Pictures and information on destination sites and online travel agencies (OTAs) remain leading influences for Asia Pacific travelers planning future trips, along with pictures and information in travel advertising. When comparing pre-pandemic and future influence among Asia Pacific travelers, content on destination sites increased by 19%, while content on OTAs increased by 18%.

Marketers should use consistent messaging and imagery across owned websites, social media channels, advertising and other content platforms to effectively reach potential travelers, and layer in regional and country-specific insights to drive engagement. For example, a destination targeting Asia Pacific travelers should use images highlighting the use of masks by both travelers and employees, such as airline crews, hospitality workers or restaurant staff, and underscore with informative messaging on protocols or requirements.