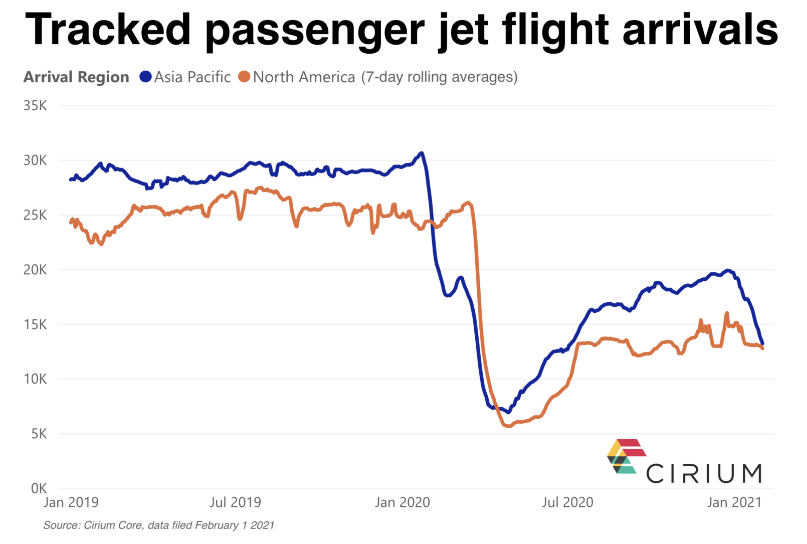

Asia Pacific appears destined once again to slip behind North America by volume of tracked daily passenger jet flight arrivals as China’s drive to discourage holiday travel in the run-up to Lunar New Year takes its toll on passenger demand in the region.

Including both domestic and dramatically-curtailed international operations, seven day rolling average flight arrivals at Asia Pacific airports had declined to just over 13,000 by February 1, down from December’s peak of nearly 20,000. North America meanwhile spent the second half of January holding steady at close to 13,000 daily flights, dipping slightly to below 12,800 on February 1 as snow storms affecting the East Coast of the USA began to spur an uptick in flight cancellations.

As the first region to feel the full impact of the initial COVID-19 wave, Asia Pacific flight levels fell below North America in early February 2020 but a faster recovery rate saw their positions reversed again by mid April as the Chinese domestic market powered ahead to record year-over-year growth by early-October. Chinese operators have subsequently suffered a dramatic reversal in fortunes just as the New Year holiday period approaches.

Cirium fleets data shows Asia Pacific operators have 19% of their 8,200 passenger jets in storage, while their North American counterparts have nearly 33% of their more than 7,700 aircraft classified as inactive.

Mass vaccination programs continue to gather momentum in many nations, fueling optimism that travel demand will bounce back later in the year, although concern about the spread of more transmissible virus strains has prompted many governments to further tighten international travel restrictions in the short term.

Global passenger jet flights remain down nearly 54% compared with last year, while approximately 40% fewer aircraft are being tracked each day operating commercial services.