Trip.com Group just filed an application in which the company aims to get a second listing on the Hong Kong Stock Exchange.

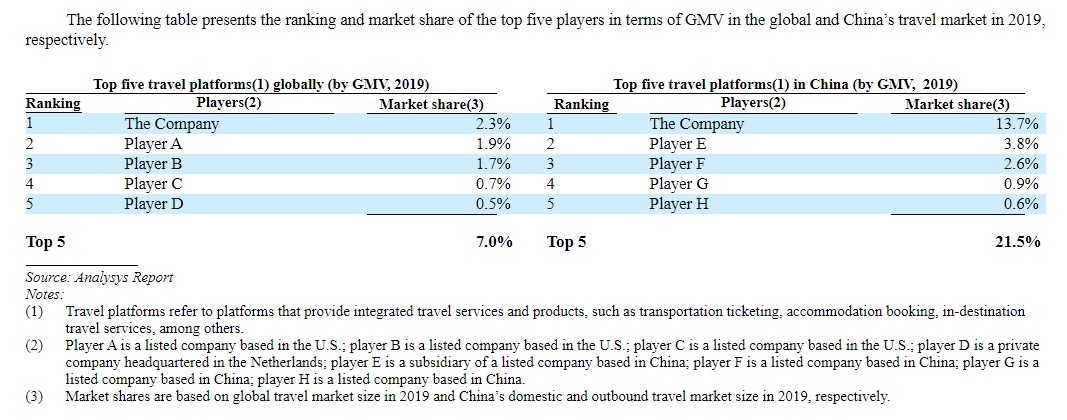

The online travel giant said in the filing that it has been the largest online travel platform in China over the past decade and the largest online travel platform globally from 2018 to 2020, both in terms of gross merchandise volume, or GMV, citing data from an Analysys Report.

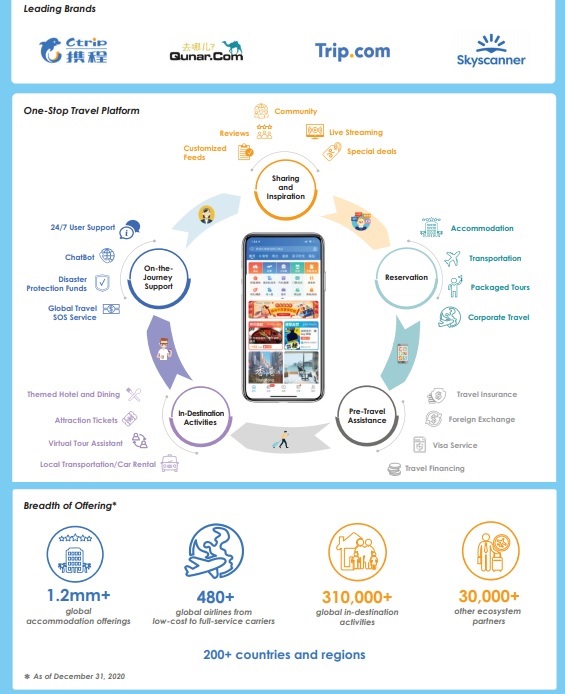

According to the filing, Trip.com Group had 1.2 million global accommodation offerings and was in distribution partnerships with 480+ low-cost or full-service airlines worldwide as of the end of 2020. The company offered more than 310,000 in-destination activities globally and worked with 30,000+ partners.

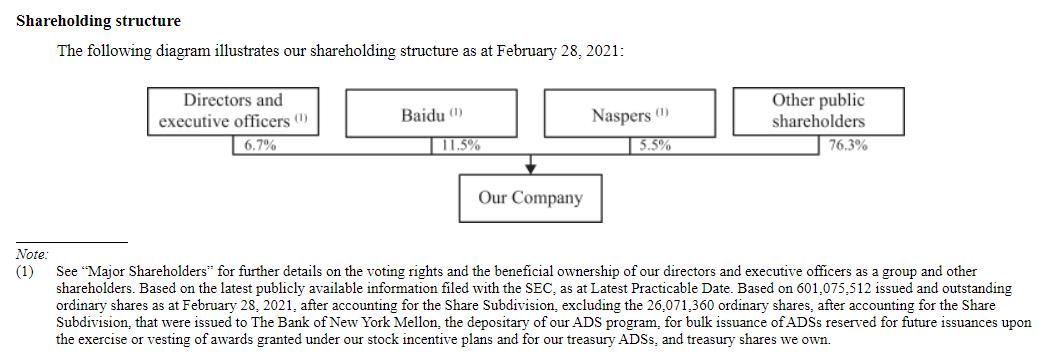

Major shareholders

As of the end of February this year, the directors and executive officers hold a 6.7% stake in Trip.com Group, Baidu owned a 11.5% stake and Naspers controlled a 5.5% stake in the company. These shareholders will remain Trip.com Group's major investors after the second listing, according to the filing.

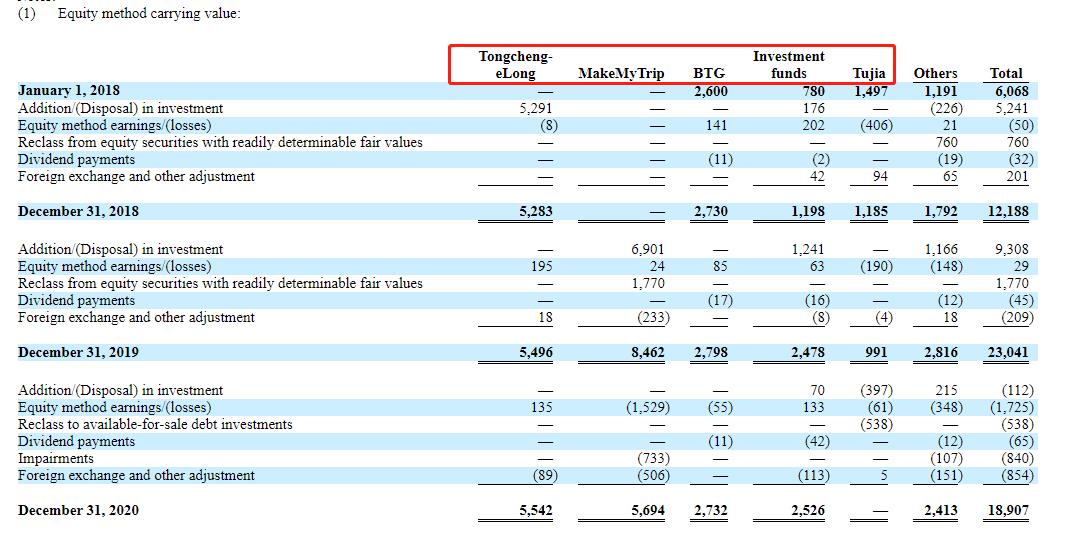

Major investments

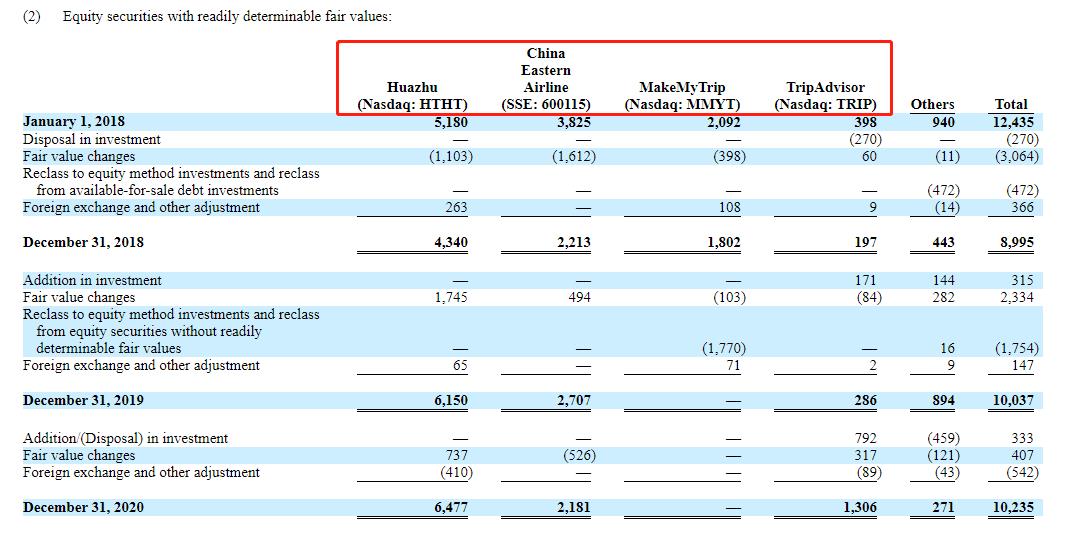

Trip.com Group has invested in major travel companies including Tongcheng-eLong, MakeMyTrip, BTG, Tujia, Huazhu, China Eastern Airline and Tripadvisor.

The company's investments decreased by 7% from RMB51.3 billion as of December 2019 to RMB47.9 billion as of December 2020, primarily due to the losses incurred from equity method investments, mainly in MakeMyTrip, which was significantly impacted by the COVID-19 pandemic.

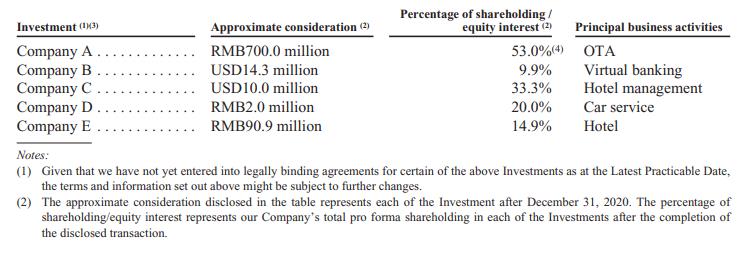

Since December 31, 2020 and up to the Latest Practicable Date (March 31, 2021), Trip.com Group has made or proposed to make investments in OTA, virtual bank, hotel management, car service and hotel.

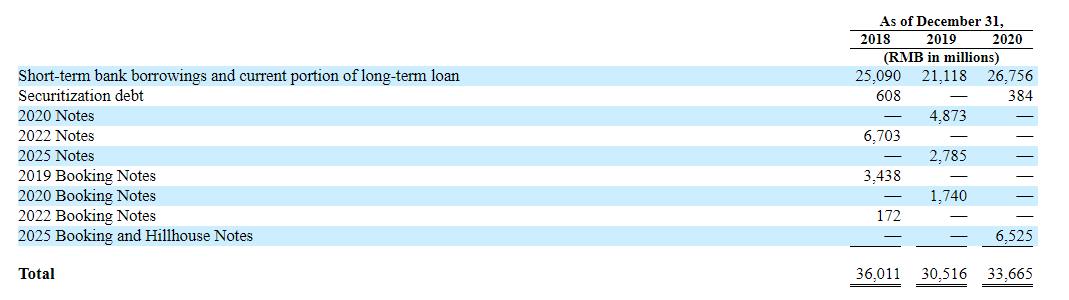

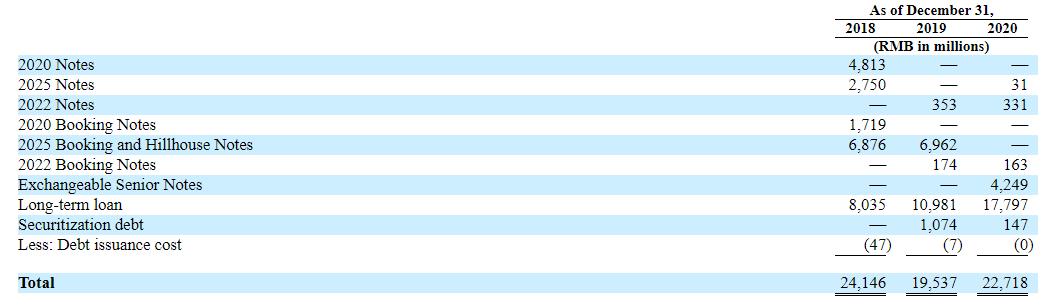

Booking still holds some convertible notes

In December 2015, Trip.com Group issued US$500 million of 2.00% convertible notes due 2025 to a subsidiary of Booking, which will mature on December 11, 2025. The 2025 Booking Notes bear interest at a rate of 2.00% per year, payable semiannually beginning on June 11, 2016.

In December 2015, the company issued US$500 million in aggregate principal amount of 2.00% convertible notes due 2025 to Gaoling Fund, L.P. and YHG Investment, L.P., or collectively Hillhouse, which will mature on December 11, 2025. The 2025 Hillhouse Notes bear interest at a rate of 2.00% per year, payable semiannually beginning on June 11, 2016.

In September 2016, the company issued US$25 million in aggregate principal amount of 1.25% convertible notes due 2022 to a subsidiary of Booking, which will mature on September 15, 2022. The 2022 Booking Notes bear interest at a rate of 1.25% per year, payable semiannually beginning on March 15, 2017.

Market potential

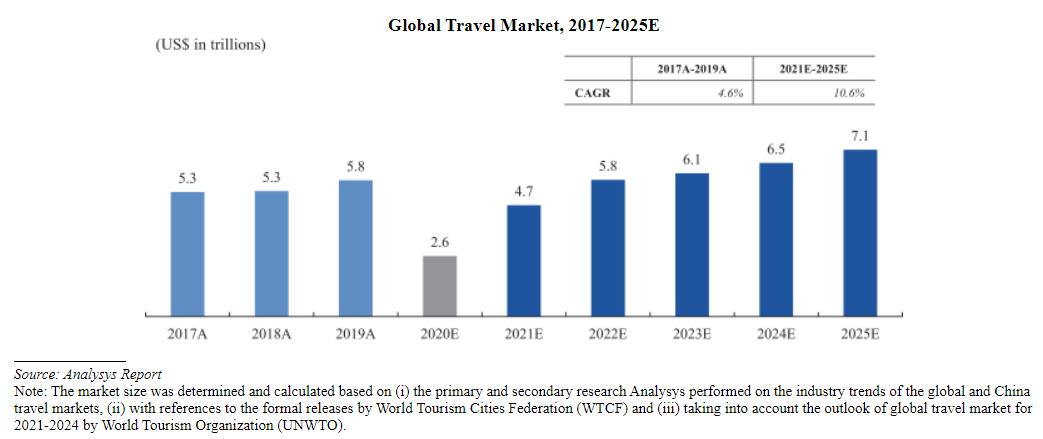

After a decrease in 2020 due to the COVID-19 pandemic, the global travel market is expected to resume growth in 2021 and reach US$7.1 trillion by 2025, mainly driven by continuing rollout of COVID-19 vaccines, increasing consumer interest in travel, and rising consumer spending power, especially from emerging markets such as Asia, according to the Analysys Report.

According to the Analysys Report, China has become the largest travel market globally in terms of the total number of domestic and inbound trips, which was 6.2 billion in 2019 and is expected to reach 7.5 billion in 2025, despite a drop in 2020 due to the COVID-19 pandemic. During 2019, the market size of domestic and inbound travel in China was RMB6.6 trillion (US$1.0 trillion), accounting for 18% of the global travel market.

Despite its current massive size, China’s travel market still has great potential for further growth. China’s travel market is expected to quickly recover from the impact of the COVID-19 pandemic in 2020 and reach RMB10.1 trillion (US$1.6 trillion) by 2025, representing a CAGR of 11% from 2021, according to the Analysys Report. Chinese travelers’ average spending per trip was US$158 in 2019, significantly lower than that of U.S. travelers at US$873. In the foreseeable future, China will continue to be a major market for the global travel industry, driven by robust economic growth and ongoing consumption upgrades.

The Analysys Report identified four major market trends for travel in China:

* Consumption upgrade driven by mass affluent population.

* Preference for diverse travel options and quality experience.

* Structural shifts towards inspirational and comprehensive user engagement.

* Technology-driven supply side evolution.