How To Get Former Employee Walmart W2 From in 2023?

What Is a W-2 Form?

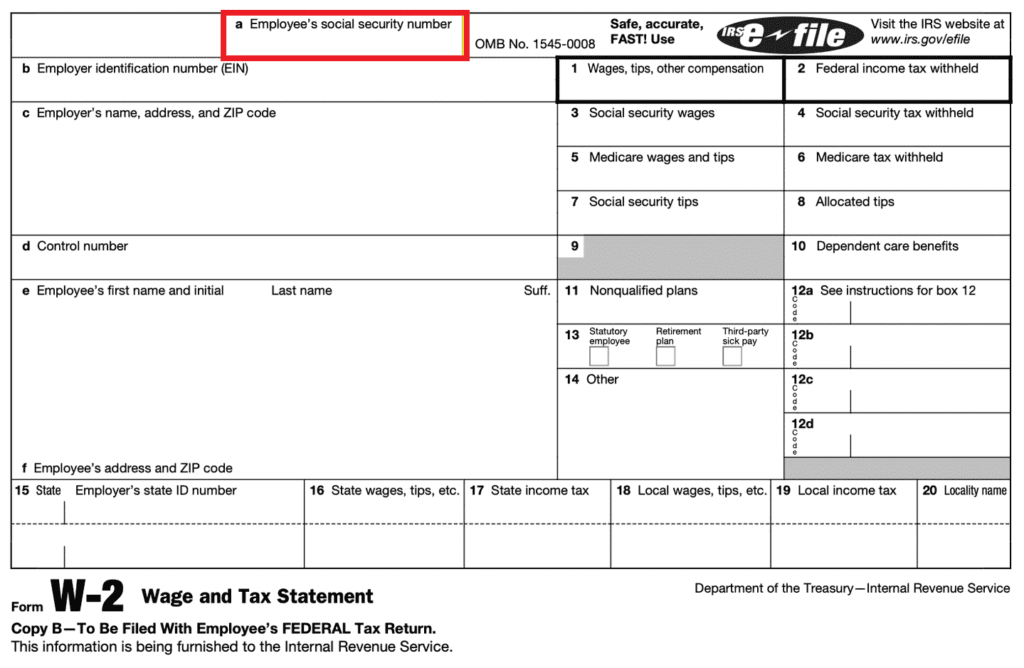

This is the tax return form of the USA that has to be filed by all business houses employing staff members and sent to them with all records of deductions. The employers fill in this form with details of payroll taxes. Earlier known as the Wages and Tax Statement, this is now known as W-2 Form. An employer will give all information like tax withheld, bonuses, wages, and credits and send this form to the employee. For all associated with the company, Walmart w2 acts as a vital document.

Thank you for reading this post, don't forget to subscribe!Does Walmart Mail Out W2 Forms?

Walmart has developed a system that streamlines everything and makes it easier for them to send out W-2 Forms to the employees. Walmart employs a very large number of employees in the USA (and elsewhere in the world).

[Read More: Few Tips for Growing Your Ecommerce Business with Online Grants]

When Does Walmart Send Out W2 Wage and Tax Statement Form?

An employer has to send this form to an employee by January 31st of every year. Walmart issues Form W-2 between January 31st to February 28th. Walmart has made its own online system to send out Form W2.

Where Can I Get My Walmart W2 Form?

Walmart has its own Payroll Services Department. This department is meant to deal with your W2 form. You can get your Walmart W-2 from this particular department.

The best way to receive this form is to:

- Sign in to your employee account on OneWalmart

- Download the form W-2.

Is There Any Other Way To Obtain W2 Form?

Sometimes, a Walmart employee may face a few problems in obtaining this form. In such a case:

- You should contact Walmart Field Support, who will guide you through the procedure

- If your Form W-2 is not appearing in your account, you can contact the Walmart Payroll Department.

How To Be Sure That W2 Form Is From The Walmart Inc.?

You can ensure that the form is from Walmart by checking the EIN number on the copy of your worm. If the EIN number is 71-0415188 you can be sure that the form belongs to Walmart. This will prove the authenticity of your form.

Where I Can Find EIN On My Walmart W-2?

EIN is a 9-digit number that you find on your W-2 Walmart form. The easiest way to find out this number is to go to Box B. You will find Employer Identification Number or EIN in that particular box.

What I Do If an Employer Cannot Give My W2?

It is unlikely that you would not get your W-2 from your employer. However, if happens by any chance due to errors or oversight, you can:

Contact the HR department of your company and ask for the W-2. After making queries and taking the necessary steps, HR will give you the required W2 Form.

You can seek more time or ask for an extension of time to file your tax return by submitting Form 4852 to the IRS.

Your third option is to contact the payroll service department of Walmart. You can put up a written request informing Walmart of the non-receipt of form W2.

What To Do If I Find Mistakes On My W2 Form From Walmart?

This may happen, though very rarely. You may find mistakes on your W2 form. In case it happens, you should:

Intimate Walmart about necessary details missing in your form.

It may happen that Walmart failed to withhold the proper amount of federal tax. In that case, talk to the payroll service department of Walmart and put up a request in writing to ensure that the proper amount of money and details are withheld in the future.

Your third option is to file Form W-2C with a separate Form W-3C for needing corrections to see changes in the W2 form.

[Read More: Why to Include Content Marketing in eCommerce: 5 Strong Reasons]

Does Walmart Provide W2 and Income Tax Information During Tax Season?

Walmart distributes W2 and Income Tax statements during tax season to each employee for the financial year in question. You can always check your email for a W2 form copy and see the IT information that you may need.

What Information Needed To Log In To The Online Access Portal?

You need to feed certain information to use Walmart’s online access portal.

i. WIN (Walmart Identification Number)

ii. SSN (your Social Security Number)

iii. Website address of the Walmart employee portal.

Can You Get Your Walmart W-2 Online?

Yes, you can get it online. To get it online, you have to:

i. Visit Walmart’s official site

ii. go to the OneWalmart application/portal

iii. log in using your details already fed to Walmart’s system

iv. put up a request for online receipt of W2

How To Get Form W-2 As A Former Employee Of Walmart?

As an ex-employee, you can get your W-2 mailed directly to your home address already registered in the Walmart database.

How To Login To Online Access For W-2.

If you want to view your W-2 online, you have to log in taking the necessary steps which are:

i. Visit the official website My Tax Form (www.mytaxform.com) after login.

ii. Give an employer code which is 10108 for Walmart; enter your Social Security number, and initial PIN, and log in to your account.

iii. Answer all security questions like your email and contact information. Doing this will change your initial pin, and now you will create a new PIN. This is for first-time users. Regular or old users can simply log their accounts.

iv. Go to the dashboard, confirm your identity by answering security questions, and OTP via phone call/message. After this, go to the My Account menu and select Receive Forms Online as your default delivery option.

v. You can now receive your Form W-2.

What To Do If Walmart CanNot Give Me My W-2?

If you’re unable to get your form from Walmart w2 online you have three choices. First, you can send a written request, for your form. If that doesn’t work, reach out to the payroll department. Ask about the status of your form W2. If the deadline for filing taxes is approaching and you still haven’t received your form you can go with the option of one Walmart wire or OneWalmart app.

The third option involves filling out form 4852 which grants an extension, for filing your tax return. This extension gives you six months to file your return allowing time to ensure that you have your W2 form.

In that case, you can also send a request for a copy of your W-2 by calling the MyTaxForm customer service center at this number: 877-325-9239.

[Read More: Meesho Seller Login – Online Fashion Shopping]

In Conclusion

Walmart issues W-2s for each and every employee. It is a valuable document for all employees. This form is sent to the employees between Jan, 31st to Feb, 28th every year. It gives a full statement of annual wage and tax deductions which is vitally important for the Internal Revenue Service (IRS) and Federal Insurance Contributions Act (FICA).

Frequently Asked Questions

The Employer Identification Number of Walmart is known as the EIN number. This number is 71-0415188. The EIN number is always mentioned on the form W-2.

Yes.

In such a case, you should contact the MyTaxForm customer service center at this number: 877-325-9239.

The online access portal for employees is www.mytaxform.com.

You can find the EIN of any employer in Box B of Form W-2. This is a nine-digit number in Box B.

Visit Walmart’s official site, then go to the OneWalmart application/portal and log in using your details already fed to Walmart’s system, then put up a request for online receipt of W2.

You can get the form W-2 directly mailed to your official residential address already entered in the record of Walmart.

Your best way to solve this problem is to approach the MyTaxForm customer service center at this number: 877-325-9239.